Did the Fed cause our Economic Problems & Other Market News for the Week Ending April 8th 2022

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com

For investors regardless of whether you are a professional investor or not this is a very difficult time to figure out the market. The NASDAQ and the Russell 2000 were down more than -3% last week and the S&P was negative -1.27%, the DOW was relatively flat at -.28%. The 10-year Treasury jumped to 2.715% meaning that the price dropped by 14%. Translated; the value price of your bond declined. Typically, investors that seek stability in volatile market environments move to Fixed income products, but we are seeing as much volatility in the fixed income market, so the only safe haven is cash but that is being impact by inflation. Last week's decline came from concerns about the potential economic impact from the Federal Reserve's Federal Open Market Committee minutes released last Wednesday showing a more aggressive monetary tightening plan than previously anticipated.

On Tuesday, Federal Reserve governor Lael Brainard said the central bank's policy-setting committee will be "starting to reduce the balance sheet at a rapid pace as soon as our May meeting." Wednesday, minutes released from the committee's March meeting showed officials were considering raising rates by a half-point before they ultimately decided on a quarter-point increase. These were seen by investors as signs the Fed's tightening plan may end up more aggressive than previously expected. But more importantly the minutes contradicted Chair Powell’s comments during last month’s press conference which led the markets to believe the discussion had not yet taken place.

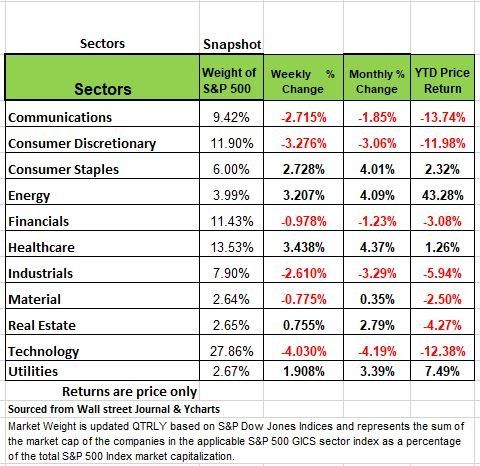

Last week's drop also comes ahead of the start of US companies' financial results for Q1, a tumultuous quarter that was dominated by headlines about COVID-19, Russia /Ukraine conflict, rising inflation and supply-chain issues. Many investors are trading cautiously ahead of Q1 financial reports. By sector, 5 of the 11 sectors were in the red, with technology and consumer discretionary sectors having the largest percentage drops, down -4.03% and -3.27%, respectively. Other sectors in the red included communication services -2.71%, industrials -2.61%, financials -.978% and materials -.77%. On the upside health care sector climbed +3.4%, followed by a +3.2% increase in energy, a +2.7% gain in consumer staples and a +1.9% boost in utilities. Traditionally these are the defensive sectors so investors are most likely reallocating money into those areas

Overview

Geopolitical risk has increased the uncertainties already present in the macroeconomic environment. Markets began the year contending with inflation pressures, monetary policy, deceleration of growth, and liquidity concerns. In addition, we now have to consider the effects of elevated commodity prices, disrupted supply chains, and low consumer sentiment as well. Lack of clarity on each of these issues makes it difficult for assets to recover. One thing we do know is that the path forward will continue to be volatile as economic issues impact progress in the near-term. Below are some thoughts on a few areas concern.

- Volatility is acute, caused by economic obstacles, a black swan event (Russia Ukraine conflict). Returns are going to be a challenge, However, for investors with a longer time horizon, pockets of volatility can present buy opportunities if you can stomach the ride.

- Monetary policy has finally caught up with us and we are feeling it now across the economy. High demand and excess money in the system has caused our current inflation challenge. The only way for the Fed to cure inflation is to reduce that demand by reducing money supply in the system. Remember the cure for higher prices, is higher prices. This means slowing an economy even faster than it is already slowing. But it may come with consequences, as we have penned in the past, this will not be an easy landing for the Fed, to slow inflation without stalling the economy. Markets have recently priced-in the probably of a uber-aggressive Fed tightening cycle by using the end state of interest rates, at least its best guess and QT balance sheet reductions which is twice as fast as occurred in the Fed’s bungled 2018 QT effort.

- According to the Fed’s own Atlanta Regional Bank, Q1’s real GDP growth will be around a +1% (keep in mind two-thirds of Q1 was prior to the economic issues from Russia’s invasion of the Ukraine). So we expect the expect GDP growth for the year will be a moving target.

- Mortgage rates have risen from 3% to 5% during Q1, and not only have consumer plans to buy homes, cars, and appliances tanked, but mortgage applications have succumbed too.

- Wages are growing, but not keeping up with inflation, (stagflation is approaching quickly) In addition surveys show that consumers at every income level are becoming more frugal, with so much being spent on Gas, Food and rent, not much being left over for discretionary items

We do think that the the incoming data over the next few months will be disappointing, so if the Fed is truly “data dependent,” it will not fully execute either the interest rate hike guidance (dot-plot) or the recently released QT intentions ($93 Billion/month) . Stalling the economy (a recession) will be worse that the inflation.

We should expect price volatility, early-on in the equity markets as QT begins. We believe that the markets’ rapid pricing-in of the Fed’s forward guidance (i.e., the interest rate spikes) has already negatively impacted the economy’s growth path.

Incoming Data that leads us to our opinion

- Energy is 8% of the CPI calculation. There is “backwardation” (a finance term when the current price, or spot price, of an underlying asset is higher than prices trading in the futures market) in the oil futures market, and, perhaps, this will translate into some relief at the gas pump. Domestic drilling is up 50% Y/Y.

- Food is 13% of the CPI calculation. The U.S. is a net exporter of food and farm output is rising (3%) faster than domestic demand (1%). Drought in CA. and the availability and cost of fertilizer remain a perplexing issue. At best we think this will level out not recede

- Rent accounts for 30% of the CPI. As we have observed in several of our past articles, multi-family starts have been at levels not seen since the 1970s, and finished units are just starting to hit the market. Already, apartment vacancy rates are up to 4.6% from 3.8% last summer. But don’t forget landlords were burned by renters during the pandemic by not paying rent with funds provided by the government. So we think this will level out by mid-summer

Together, rent, food and energy account for more than half of the CPI calculation. Of course, food and energy are impacted by the war in the Ukraine. Nevertheless, incoming data would seem to imply that there is some relief coming in these areas. Thus, if the Fed is really “data dependent,” they may not feel the need to fully execute their current dot-plot plan and raise interest rates as aggressively as projected.

- The ISM Manufacturing March Index came in at 57.1 vs. February’s 58.6. The consensus was for a rise to 59.0. Its going in the wrong direction and March's number will be giving us a clearer story.

On Friday (April 8) CNBC featured a story entitled: As Inflation bites and American mood darkens, higher-income consumers are cutting back, too. The story said that American consumers have already cut back on spending. Those living paycheck to paycheck have little choice, the story noted, but the survey also said that higher income consumers are showing signs of financial stress and have been cutting back on dining out, travel and vacations, and have reduced plans to purchase cars.

Real Disposable Personal Income (i.e., after accounting for inflation) has fallen in seven of the last eight months and is down at a -4.7% annual rate over that time period. So while some people are still projecting a more robust economy and sticking to the “pent up demand” narrative the information mentioned above seems to contradict that optimism. Source Bob Barone Ph’D Economist

Sellers’ Market or Buyers’ Market

If you are a homeowner and fear missing out on the right moment to stake the “For Sale” sign in the front yard, your window may be narrowing quickly. The mood among sellers seems to have shifted in recent weeks from apathy about the slow boil of higher rates to urgency. Sellers are seeking advice on how best to time the market and tame their anxiety. But if you are only concerned about making a profit then don’t be greedy, take the money and run if you are at the next stage of your life. While everyone is looking to maximize profit remember that a game plan needs to be in place and to avoid capital gains you need to purchase another home in a short period of time. Think it through. While Higher rates should cool prices in theory, home buyer demand seems resilient and, in a further boon to sellers, the inventory of homes on the market remains low. But one reason for this is the number of institutional buyer that came to the market. As we have discussed in previous post the artificially low interest rate environment that we have experienced over the last 13 years have led institutions to crave yield, so they purchased home for cash and use the rental profit as yield. So, if you’re a seller you may want to act quickly given that, as the Federal Reserve Bank of Dallas put it, “there’s growing concern that U.S. house prices are again becoming unhinged from fundamentals.” Remember 2008? Source https://www.wsj.com/articles/as-mortgage-rates-rise-home-sellers-fear-time-is-running-out-to-cash-in-11649275058

Exit strategies for Retirement accounts

Putting money into a 401(k) is simple. Taking money out often requires an exit strategy. But one thing we know is that the tax breaks baked into retirement accounts don’t last forever. Retirees or their heirs eventually must start draining their balances by taking annual withdrawals known as required minimum distributions (RMDs), triggering tax liabilities. The liabilities are all based on income during a specific year which may also put the recipient/beneficiary into a higher tax bracket.

The rules for RMDs changed recently and could change again soon, reshaping the way people plan for retirement and hopefully create more opportunities for some retirees to reduce future income taxes.

Last week, the House of Representatives voted to delay the age at which people must start taking money out of most retirement accounts to 75, from 72. If the bill, which currently has bipartisan support in the Senate, becomes law, it would mark the second time in three years that Congress raised the required distribution age. However, the schedule may also increase so while pushing off RMD’s to a later age it may also increase the amount to be distributed. This move can benefit those who can afford to sit on nest eggs longer to allow for more tax-deferred growth, but may also trigger estate tax issues

In addition to complicate the picture is recent IRS guidance that requires many who inherit retirement accounts to drain the inheritance quicker, meaning higher distribution amounts and larger tax consequences and tax brackets. So depending on the value of your estate you may want to reevaluate your strategy to pass on to the next generation and potential tax liabilities. Source https://www.wsj.com/articles/the-new-tax-playbook-for-draining-your-401-k-in-retirement-11649079814

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/