The Delta Variant, The Fed's Summit, A new Employee Benefit & Other Economic News for the Week Ending

August 27th 2021

The big news last week (Outside of Afghanistan) was the Jackson Hole conference which was held via Zoom due to the rapid spread of the Delta Variant. Investors waited with anticipation to hear what Fed Chair Powel had to say about the economy and future actions of the Fed.

There was growing concern on what Powell would say since some Regional Fed Presidents have voiced their opinions over the last few weeks about their view of the economy, especially inflation.

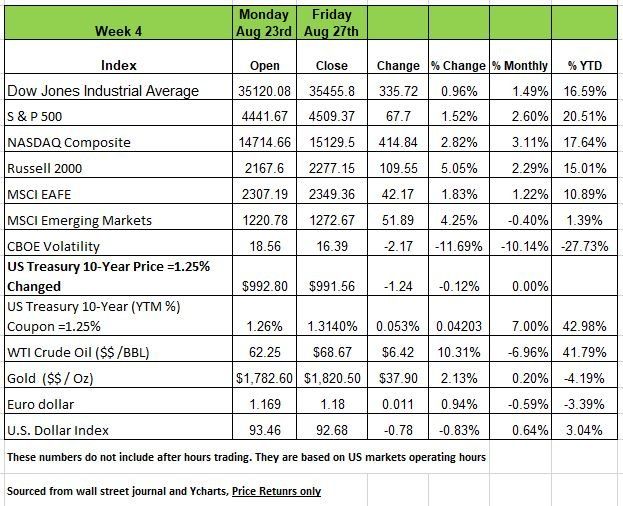

As a result, interest rates, as measured by the 10-Year Treasury, spiked from 1.26% on Friday, August 20 to 1.34% on Thursday, August 26. Powell remained consistent with his past statements, i.e., inflation will prove to be “transitory” and while there has been improvement in the economy, the Delta-variant is concerning.

He also reiterated that the FOMC (Federal Open Market Committee, the Fed’s policy making committee) would, when it meets, base policy on the emerging data and those trends. He did say that the FOMC would discuss the $120 billion/month purchases of Treasuries and Mortgage-Backed Securities at the (September) Fed meeting while being careful not to indicate when any tapering of those monthly purchases would start or how long the process would take. As a result, rates fell dramatically after his speech, ending the day down to 1.31%.

The U.S. equity indexes rallied significantly on Friday as investors weighed the tragic events in Afghanistan against more transparency on the Federal Reserve’s monetary policy timeline.

Small caps led the advance, with the Russell 2000 Index soaring 5%, while the Nasdaq Composite rose nearly 3% and the Dow and S&P500 added 1-1.5%.

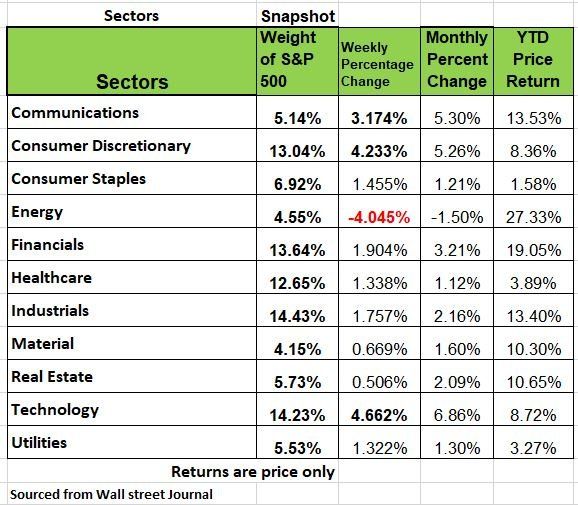

Seven of 11 S&P sectors posted gains, led by energy (+7.3 %), financials (+3.4%), basic materials (+2.6%) and industrials (+2.2%), while the defensive sectors like consumer staples, utilities, healthcare fell as risk-on flows dominated.

Crude oil rebounded with a 10%+ jump, and gold prices rose 2.1%. We expect oil to continue increasing this week in the wake of Hurricane Ida’s impact on the refineries in LA.

Despite PCE Core Price Index data showing annual price increases at a 30-year high of 3.6%, Powell reiterated that higher prices aren’t broad-based, surge-price categories are moderating, and that both wages and long-term expectations don’t suggest “excessive inflation”. He also affirmed that asset purchase tapering is likely to begin later this year, but that interest rate hikes aren’t on the table until the more stringent maximum employment test is met.

In other U.S. economic news, August Flash PMIs showed continued expansion, although at a slower pace than July and slightly below expectations. Existing home sales rose 2% in July, with all the annual gains in homes priced above $500K, while new home sales ticked up 1% in July.

Labor Market

The media mentioned in passing that the weekly state Initial Unemployment Claims (ICs) rose +4K). Because that number doesn’t fit the “economic boom/inflation” narrative, there was little further media analysis. As we have mentioned many times in this blog, the pandemic isn’t seasonally adjustable. The Not Seasonally Adjusted data, at 298K, was down -11K from the price week’s (revised) 309K level, moving ever closer to the 200K that was the pre-pandemic norm. Actually, a positive.

We look at the state data alone because, if the Pandemic Unemployment Assistance (PUA) programs 1099 workers does end in September as scheduled, then the state programs will be all that are available. It is noteworthy that the ICs in the PUA programs have been rising since early June. This data complements our observations from Open Table and the TSA, i.e., a notable slowing in economic activity

But we feel that perhaps there is a lot of fraud in this numbers.

Labor Market- Continuing Claims Using the Continuing Unemployment Claims data (CCs), the majority of the improvement has come from the Opt-Out states (those states not paying the $300/week federal unemployment supplement).

The percentage improvement in Opt-Out states was nearly twice that of those states remaining in the federal program (Opt-In states), a very strong indication that the federal program has dis-incented work and is at least a partial cause of the perceived labor shortages.

Note: The preliminary data in CA are highly volatile and, therefore, unreliable. Excluding CA from the preliminary data still shows relative outperformance of the Opt-Outs. The Opt-Ins, while now possessing 69% of total claimants still only represented 39% of the unemployment reduction.

The fact that the Opt-Out states have outperformed the Opt-Ins on a weekly basis over the 3.5-month period examined is strong empirical proof that the federal $300/week supplement is a significant work disincentive.

The PUA programs end in early September. There are 9 million in those programs that will not be getting unemployment checks. That leads us to believe that the scarce supply of labor that businesses are experiencing may well turn into a tsunami in this year’s Q4.

Consumer Staples:

The Consumer Staples sector includes food, beverage and tobacco products; and food distributors (e.g., supermarkets, hypermarkets); non-durable household goods (e.g., detergent and diapers) and personal products (e.g., shampoo and cosmetics).

The ongoing recovery in the economy and shift toward cyclical sectors has resulted in underperformance of the sector since the market low in March 2020—as would be expected for a defensive sector whose constituents are typically less affected by changes in the business cycle. However, with the prospects of reduced social distancing and full reopening of restaurants, food wholesalers that service restaurants have regained some footing, but at the expense of some big-box stores. In general, retailers within the sector have aggressively cut costs, leaving them in reasonable financial condition. But limited pricing power in a low-interest-rate environment gives them less–than-exciting top-line growth potential—though this could change if inflationary pressures prove to be enduring and higher cost can be passed on to consumers.

With additional fiscal stimulus, rollout of the vaccines, and accommodative monetary policies, we think the economy has shifted into the expansion phase. At this stage of the business cycle, the consumer staples sector typically underperforms the overall market. We think growing confidence in the economy will continue to weigh on relative performance going forward—though perhaps excessive exuberance in the markets could spark volatility that would favor the defensive sector.

Positives for the sector:

It typically has a stable earnings profile.

Companies have engaged in aggressive cost-cutting.

Restaurant openings are supporting wholesale food demand.

Negatives for the sector:

An improving economy and strong stock market historically typically make this defensive sector relatively less attractive to investors.

Companies tend to have limited pricing power in a low-inflation environment—notwithstanding the recent surge in prices for some retail staples.

Risks for the sector:

The additional government stimulus and successful distribution of the COVID-19 vaccines could further support the economy and reduce stay-at-home food and staples demand.

The sector could perform better than expected if inflationary pressures enable more pricing power.

The Delta-variant Impact

Household Income: Household income did rise in July (+1.1%) as Washington began sending cash to some households which would be filing 2021 taxes using dependent child tax credits. Such checks will continue through December, with America’s households now having to reimburse the government come tax return time in 2022.

These tax credits, having now been paid out in cash, will not be available to offset 2021 taxes, and many unsuspecting households will either get a much smaller than anticipated tax refund, or will unexpectedly have to find the cash to pay tax. We believe this will have negative growth impacts in Q1 and Q2 2022.

Spending: Because of such continued fiscal stimulus, including that from the unemployment programs, total consumer spending rose +0.3% in July, down from June’s 1.1% rise. July Retail Sales (spending on goods) fell -1.1%; -1.6% after adjustment for inflation. Spending on services was up in July. But, since summer’s start, spending on services appears to have slowed significantly, and such sluggishness appears directly related to the Delta-variant.

There has been a rash of cancelled concerts, industry conferences, and festivals. Instead of personal meetings, America’s businesses continue to rely on virtual meetings (e.g., the Fed’s symposium) which impacts the travel and leisure/hospitality industries significantly.

In examining June, July and August (through August 26) Open Table reservation data for 2021 relative to pre-pandemic 2019. In June, there were four days where 2021 reservations exceeded those of 2019. In July, there were three such days. None in August.

In June, on average, reservations were -9.7% lower than in June, 2019. In July, that showed improvement to -4.8%. But, it deteriorated in August to -10.0%.

A similar pattern emerges when we examine TSA passenger count data. Compared to 2019, June’s passenger counts were down -26.0%. They improved in July to -20.4%, but for August (through the 26th) they fell back to -22.6%. We believe that this may slow even further, noting in particular that David Ige, the Governor of Hawaii, has publicly urged tourists to “stay away” from the Islands!

Data

Evictions: The U.S. Supreme Court ruled last week that Executive Orders banning evictions are unconstitutional. Unless Congress acts quickly, tenants will either have to pay their current rent and some back rent, or be put out on the street. No one wants to throw an individual on the street, especially a family with young children but the dilemma here is responsibility or irresponsibility. Almost all of these people received money from the government and took that money to purchase discretionary items. Not caring about rent. So we know with this we will see a drop in consumption, with rent+ back rent having to be paid, consumption will inevitably fall.

Inflation: In his presentation at the Kansas City Fed’s Jackson Hole Symposium, Powell once again emphasized the “transitory” nature of the current inflation. “Transitory” doesn’t mean prices will fall (although some prices will, like gasoline and the prices of homes). “Transitory” means that they will stop rising, at least stop rising at an unacceptable pace (the Fed thinks 2% is okay). The July Personal Consumption Expenditure (PCE) Deflator, an index similar to the CPI that is closely watched by the Fed, rose +0.4%, a little slower than June’s +0.5%. Excluding energy (mainly vehicle fuels), July’s rise was only +0.3%, 60% of June’s +0.5% increase. By that metric, “transitory” starts to make a lot more sense.

Housing: While new home sales rose +1.0% in July (708K Annual Rate (AR)), slightly higher that Wall Street’s consensus estimate of 697K, such sales are -28.7% lower than in January (993K) and -15.8% below the Q2 monthly average. In some of our previous newsletters we have discussed the University of Michigan’s Consumer Sentiment Survey indicating that U.S. consumers are out of the home buying market (40-year low for buying intentions). Inventory of new homes has risen to a more normal 6.2 months’ supply (was 4.2 months in March).

What is fascinating is that all cash purchases (investors buying to rent out) sales as a percentage of total sales are at a 16 year high. Clearly investors are buying homes with the exodus from central cities continues along with the growing likelihood that a significant portion of former office staff will continue to work from home in the future. We don’t think this is going to be a long term trend

China: Normally, the run-up in commodity prices occurs when China is in rapid expansion mode. It’s no different this time. And, each time, the inflation-phobes come out of the woodwork proclaiming a 1970s style systemic inflation has begun.

There are several commodities that have seen significant reversals, including Lumber:-72%, Iron-ore: -36%, and Copper: -15%. Such pronounced moves normally occur when there is low demand from China. Economist David Rosenberg thinks the Chinese Economy isn’t just slowing – it is contracting.” He indicated that over the five months ended in July, retail sales there are down at a -18.5% AR, -9.7% for Industrial Production, -7.4% for exports, and -9.8% for imports. The unemployment rate there has ticked up and inflation has been flat. Source Bob Barone PhD Economist

A New Employee Benefit is emerging

There is a new employee benefit evolving from the pandemic and it is very beneficial to employees.

The pandemic demonstrated just how ill-equipped people are for an emergency. So, employers are taking action, in part many Americans are just unprepared for financial emergencies. More employers are now adding emergency savings accounts to employee benefit programs, reflecting a desire to attract and retain workers and help them better prepare for unexpected expenses.

Under way since before the pandemic, the trend has really picked up steam in recent months, with companies encouraging employees to fund emergency accounts, in some cases by offering them cash and other incentives for participating.

“Employers are aware that if you can’t cover your day-to-day expenses, you’re not going to save for long-term goals, such as retirement,”

Source:https://www.wsj.com/articles/the-new-employer-benefit-matching-emergency-savings-11630065600

The Week Ahead

Based on the market’s reaction to Powell’s Jackson Hole speech, investors seem to feel they have more clarity around the Fed’s intended path and can avoid another “taper tantrum”. That said, geopolitical tensions and coronavirus variants may affect economic growth or dent consumer sentiment. Powell made it clear how strong the link is between jobs and potential rate hikes, and this week will bring several updates on the labor front, with the ADP report on Wednesday followed by non-farm payrolls on Friday. China’s Manufacturing PMI arrives Monday, where the government continues regulatory crackdowns that keep Chinese stocks under pressure. Tuesday is busy with German employment numbers, Canadian and Australian GDP updates, and U.S. consumer confidence. Oil’s recent volatility will focus traders on Wednesday’s OPEC meetings, as global growths concerns have eased somewhat, and increased crude production is expected. Lastly, U.S. ISM manufacturing and services PMIs are anticipated to fall MoM while still remaining in growth mode.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/