Consumer Confidence Tanks & Other Economic News

for the

Week Ending August 13 2021

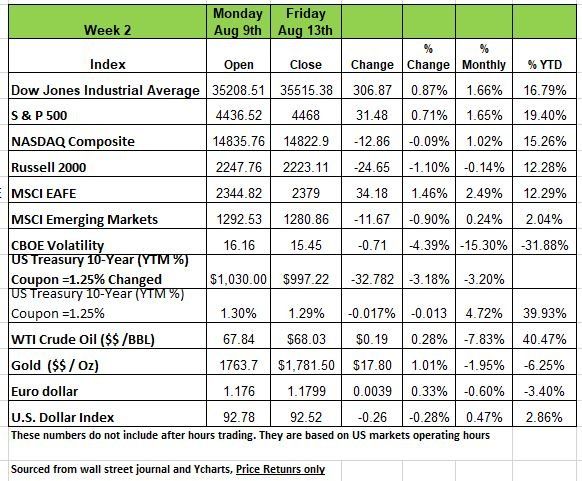

The markets were relatively flat last week with modest gains in the DOW and the S&P 500 the NASDAQ and the Russell were down -.09% and -1.10%. The coupon on the 10-year Treasury dropped 40 basis points to 1.25 at auction.

We keep hearing that the S&P 500 Index finished the week with another all-time closing high of 4,468. Equity markets continue to climb as the index posted a 1.72% return for the first two weeks of August and is up 19.4% year-to date price only. The Dow also set a record of 35,515.38. Why are we mentioning this? Try not to get caught up in the narrative of someone trying to tell you on how much you are missing out. The current environment is a bit of an anomaly and has been kept a float by the Fed. We think moving some of the money to cash for a while can be a wise conservative move for some investors.

Last week started on a negative note as markets opened lower on Monday with weekly US COVID-19 cases rising to levels not seen since earlier in the year as the delta variant continues to spread, increasing concerns of future economic growth.

The worst of the negative sentiment was felt by the energy sector as the S&P 500 Energy Index declined 1.46% and crude oil prices declined 2.64% on Monday. Stocks advanced on Tuesday as an infrastructure spending plan was passed by the US Senate.

U.S. Treasury yields rose into the 10-year auction before faltering late week, as inflation data remained hot. But keep in mind the coupon dropped to 1.25% from 1.65% July CPI rose 5.4% YoY and 0.5% MoM, in line with expectations, while core consumer price pressures moderated slightly from its prior pace as used car prices cooled significantly.

Producer prices, however, jumped 7.8% YoY, above forecasts of 7.3%, notching the fastest increase since records began in 2010. U.S. productivity grew less than expected at 2.3% for Q2, stoking stagflation fears. Sentiment numbers also disappointed, as small business optimism reversed in July to 99.7 from 102.5.

The UoM Consumer Sentiment tanked to 70.2 in early August, a 10-year low, as Americans became more concerned about the economy, inflation, and the delta variant. More on this in the article below

Consumer Sentiment

Indicators showing signs of concern, when it comes to predicting economic activity there are a number of economic indicators to keep an eye on, one of which is confidence aka consumer sentiment.

The University of Michigan’s gauge of consumer sentiment plunged to a preliminary August reading of 70.2 from a July reading of 81.2. It is the lowest sentiment reading since December 2011, far below any level since the beginning of the pandemic. There have only been six larger drops in the index in the history of the survey. Many Economists polled by the WSJ had expected an August reading of about 81. a number significanlty higher which may throw off the economic projections by many of the same economist.

Key details: According to the U of M report, a gauge of consumers’ views on current conditions tumbled 77.9 in August from 84.5 in the prior month, while a barometer of their expectations fell to 65.2 from 79 in July.

Household expectations of inflation over the next 5 years rose to 3% from 2.8% in July thanks in large part to the media

The decline was due in part to consumers sensing that the delta variant might mean that the pandemic will not end soon and that the narrative around inflation will have long lasting impact on their lifestyles. This caused an emotional reaction and generated negative assessments about the economy.

The economy has been kept afloat in large part to the Governments spending and the Feds ultra-easy policy stance. However, if cases continue to rise and consumers stop spending, avoiding crowds, the economy could darken quickly.

It’s possible that amid the potential for another wave of shutdowns, consumers are retrenching and taking a wait-and-see approach to any new spending. We do not think another shutdown is likely as the cost to both Municipalities and the Government would have other serious implications. Source: https://www.investing.com/news/economic-indicators/us-consumer-sentiment-plummets-in-early-august-to-decade-low-2589484

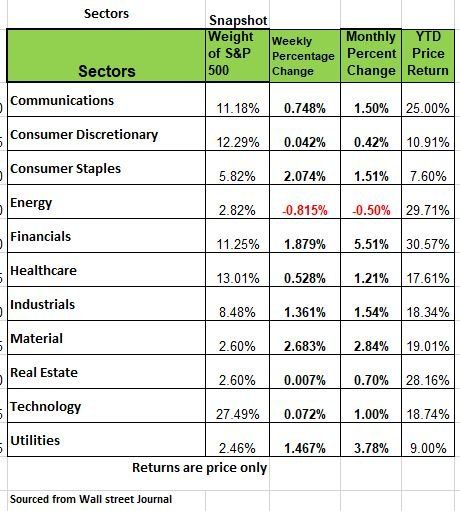

Sectors Insights

This week we are starting a series on the 11 sectors that break up the markets/economy. We start with the Communication Sector which includes telecommunication services providers, media (e.g., television, radio, print publications, advertising), entertainment (e.g., movie production, sports teams, streamed content), and interactive media (e.g., social networking websites, video games).

The stay-at-home behaviors related to the pandemic has been exceptional for some of the companies in this sector, it has led to increased use and demand for streaming entertainment, especially those with younger children, Video conferencing has allowed many businesses to stay in business while employees worked at home . Some think that the pace of enrollments is likely to drop as traditional entertainment venues reopen, however form families not concerned about the cinema experience the pricing makes streaming much more attractive for families and we think there is a wait and need before making any decisions. In addition, the shift from traditional TV and cable, advertisers have struggled generate revenues but are quickly pivoting toward online mediums.

Wireless service revenues and equipment sales are being supported by the initial rollout of fifth generation (5G) cellular technology. While the larger social media companies (Alphabet/Google and Facebook) enjoy significant competitive advantages due to their dominance in their respective business lines—search engine and social media—they also face emerging antitrust risks, head winds from Apple’s ad-blocking feature, as well as potential market saturation.

Longer term, we think the continued expansion of 5G could further increase growth within the sector, as it continues to increase demand for equipment and services. Upgrading networks will require substantial capital investment, but federal government infrastructure initiatives could result in subsidies and investment. Keep an eye on companies that can benefits

Positives for the sector:

The competitive advantage for social media;

5G rollout should boost growth potential;

Government infrastructure investment should ease 5G capital expenditure burden;

Strong streaming entertainment enrollments, but the pace has likely peaked.

Negatives for the sector:

The antitrust regulatory trend is negative for the search engine and social media companies.

Streaming services risk market saturation.

Risks for the sector:

Sector market capitalization is heavily concentrated in the top two stocks—Facebook and Google—whose adverse movement can significantly influence the sector.

Apple’s ad-blocking feature could weigh on ad revenues for social media and advertising related companies.

Trending info

A federal judge refused to block the ban on evictions covering most of America. A series of moratoriums have protected renters since early in the pandemic but the measures lapsed last month. The Center for Disease Control and Prevention introduced a new ban last week, in response to a surge in cases of the Delta variant. But the Supreme Court is unlikely to support the most recent ban unless it has Congressional approval.

Smoke from wildfires last year may have led to higher numbers of covid-19 cases and deaths in the American West, researchers at Harvard University found. Wildfire smoke contains a lot of tiny, dangerous pollutants known as PM 2.5. Exposure to such particulates, specifically from fires, can lower a person’s immune response and increase respiratory problems.

Light and bubbly: the story of champagne

It is sipped at film premieres, guzzled at weddings and sprayed at finish lines. Famous devotees include Winston Churchill, who quaffed thousands of bottles of Pol Roger, and Marilyn Monroe, who said she liked to “wake up each morning to a glass of Piper-Heidsieck”. As if not already enough of a symbol of conspicuous consumption, in 2013 bottles decorated with 19-carat diamonds were released, priced at a mere £1.2m ($1.8m).

A new documentary, “Sparkling”, explains how champagne became the luxury beverage of choice and assesses the industry today. The Comité Interprofessionnel du Vin de Champagne, a trade organisation, stipulates that it must be produced in the French region after which it is named. But two legendary champagne houses might burst its bubble. Increasingly unpredictable weather has led Taittinger and Pommery to buy vineyards in England. At a blind tasting in 2016, Parisian restaurateurs preferred English sparkling wine over the traditional stuff. Mon dieu.

Middle East

The Taliban’s reconquering of Afghanistan continued unabated, with Kabul, the capital, now firmly in the militants’ sights. Western countries prepared to evacuate embassy staff and other nationals from the city and there were long queues at the airport as people tried to flee the insurgents’ advance. A concerted assault on Kabul may only be weeks away . On Friday the Taliban captured Kandahar and Herat, Afghanistan’s second- and third-largest cities, adding to a swathe of provincial capitals now under their control. Mitch McConnell, the highest-ranking Republican in the Senate, said America’s hasty withdrawal from Afghanistan—which tipped the military balance decisively in the Taliban’s favour—was akin to its humiliating retreat from Saigon in 1975.

The Week Ahead

Despite concerns about sentiment, market breadth, and seasonal weakness, stocks continue to climb the wall of worry. Many pundits are calling for a correction, but there seems to be lack of a legitimate catalyst to create a risk-off scenario. This week the economic calendar is fairly light, but a few events bear watching. Given recent economic data and a policy committee that is growing impatient on tapering, Fed Chair Powell’s Tuesday town hall event will be scrutinized along with the July FOMC meeting minutes on Wednesday. The July U.S. Retail Sales report on Tuesday is expected to show a contraction based on slumping services spending. Regional manufacturing updates will come with the Empire State Index on Monday followed by the Philly Fed Index on Thursday. The U.S. calendar rounds out with industrial production numbers on Tuesday and housing starts on Wednesday. Internationally, inflation pressures in the UK and Canada are anticipated to ease, while Australia offers employment data as lockdowns continue. The week wraps up with retail sales reports from Great Britain and Canada.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/