US Economy contracted significantly in Q2

The U.S. economy contracted by an annualized rate of 32.9% last quarter. Keep in mind that this rate is a compounded figure based on Q 2 results. According to the BEA (Bureau of Economic Analysis) second quarter dropped 9.5% compared with the same quarter a year ago. Considering the economy was shut down for most of Q2 I was surprised that the numbers were not worse.

The most significant drop in Q2 was associated in the service arena. 22.9% of the drop was attributed to personal spending and of that healthcare accounted for 9.5 points. This is unusual as healthcare is typically considered the most stable part of GDP. However, with hospitals not performing elective surgeries and dealing with emergencies many hospitals lost money in Q2. This should rebound quickly in Q3 with lockdowns lifting. The other large component was hospitality, hotels and restaurants in particular were shuttered this rebound will be much slower since all food establishments have limitations on occupancy. Amusement parks movie theaters, as well as live theater, sporting events round out the rest of the drop

Weekly jobless claims rose for the second straight week as the above-mentioned sectors struggle to open safely to the public

https://www.wsj.com/articles/us-economy-gdp-report-second-quarter-coronavirus-11596061406

U.S. consumer spending rises for second straight month, income drops further.

U.S. consumer spending increased for a second straight month in June. This may sound a bit odd after reading the previous paragraph about GDP dropping so much. Measurements as used by sectors

Consumer spending rose 5.6% last month after a record 8.5% jump in May, the Commerce Department said.

Personal income dropped 1.1% last month after decreasing 4.4% in May as government welfare payments slowed.

The Commerce Department said on Friday that consumer spending, which accounts for more than two-thirds of U.S. economic activity, rose 5.6% last month after a record 8.5% jump in May as more businesses reopened. Consumers stepped up purchases of clothing and footwear. They also spent more on healthcare, dining out and on hotel and motel accommodation. In addition, personal savings increase $4.69 Trillion in Q2have increased significantly in Q2 an increase of 16.2% over Q1. The US Dollar index dropped to 92.68. With the exception of China all economies in the world have shrunk in Q2. Sourcehttps://www.bea.gov/

Consumer’s shun credit card debt

Typically, credit card debt increases when economies retract, as households struggle to make ends meet. When unemployment soared in the spring, we saw just the opposite.

When unemployment soared amid coronavirus lockdowns, credit-card debt in the U.S. and other advanced economies has dropped

With the deepest economic crisis since the Great Depression, the opposite happened. Credit-card debt in the U.S. and other advanced economies has fallen. Fewer people are late on their credit-card payments. Consumer demand for new borrowing—through credit cards, personal loans and even pawnshops—is down sharply. As mentioned in the previous paragraph savings is up Consumers are moving to pay for items with cash even though cash transactions seem to be something to be wary of doing. Source https://www.wsj.com/articles/consumers-flush-with-stimulus-money-shun-credit-card-debt-11596373201

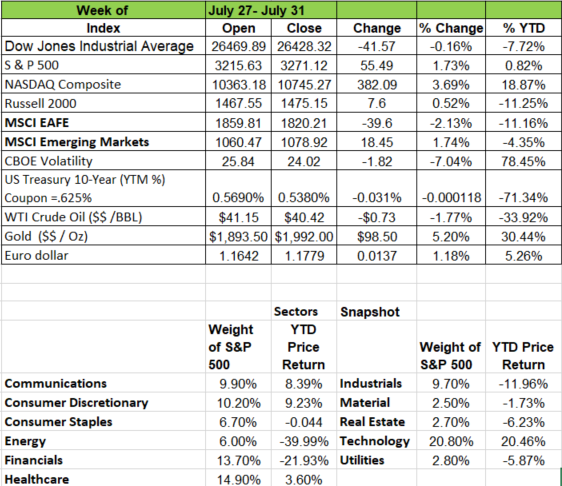

Markets rally as Dollar Tumbles Dollar

The ICE Dollar Index, which measures the dollar against a basket of other major currencies, hit a two-year low. The fall extended a reversal that began in late March, spurred lately by ballooning worries that mounting coronavirus cases will stall the U.S. economic rebound, even as growth accelerates in other countries. Source: https://www.wsj.com/articles/behind-the-vast-market-rally-a-tumbling-dollar-11596360601

When you reopen your office these links may help

Below are some links to government websites with helpful information

https://www.cdc.gov/coronavirus/2019-ncov/community/guidance-business-response.html

https://www.osha.gov/Publications/OSHA3990.pdf

https://www.eeoc.gov/wysk/what-you-should-know-about-covid-19-and-ada-rehabilitation-act-and-other-eeo-laws