March Madness

Weekly Market Review

for March 25th 2024

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

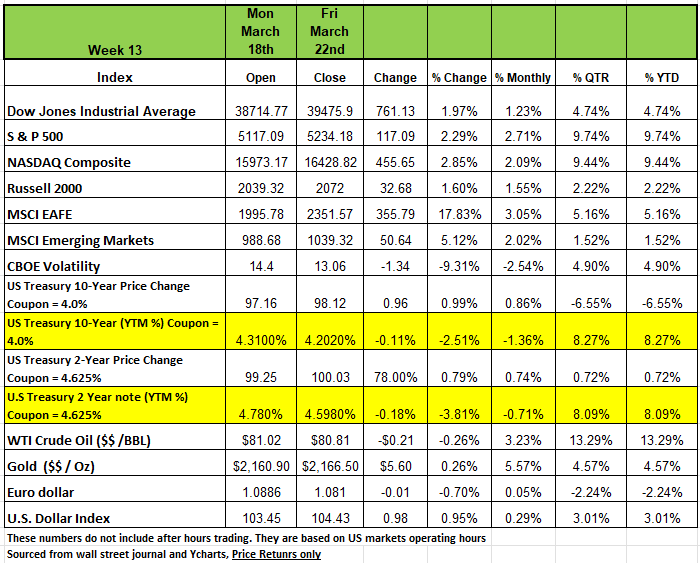

All four of the major indices ended the week in the black last week, coming off two weeks of relatively flat negative activity. The NASDAQ posted the largest return of +2.85% followed by the S&P 500 +2.29% the DOW +1.97% and the Russell 2000 +1.6%

As mentioned, all the indices posted small declines in the prior two weeks, however the index has trended up this year posting positive returns in eight of the twelve trading weeks so far. Both the S&P and the NASDAQ are up over 9% YTD. Last week equities moved up through the week with the largest jump coming on Wednesday after Federal Reserve Chairman Jerome Powell’s press conference. Though rates remained unchanged, investors’ concerns were reduced by the tone of Powells comments and the ever so popular FOMC dot plot which implied that the Fed expects three interest rate cuts for the year.

The Fed began raising rates in early 2022 to aggressively combat inflation that started running up in 2021 due to an excess increase in the money supply, free money sent to Americans and supply shortages. The hopes of reducing inflation to the Fed long-term target has proven a little stickier than anticipated. While inflation has come down significantly from its height of +9%, the target goal of 2% is still a long way off and while the last two months saw an uptick in the rate of inflation, unemployment has also moved up slightly giving the Fed Chairman confidence in expressing his willingness to cut rates later in the year to prevent a deterioration in the jobs market. This will potentially leave consumers with a longer period of enduring a higher-than-expected inflation rate.

Rate cut expectations helped fuel the equities rally and pushed the index higher, posting another all-time closing in the S&P 500 at 5,241.53. U.S. initial jobless claims of 210K last week were lower than the 213K expected and the previous week’s 209K.

Treasury yields fell throughout the week with the Fed’s outlook for rate cuts throughout the rest of the year. Yields fell on Wednesday after the Fed left interest rates unchanged for the fifth straight meeting and signaled, they expect three rate cuts in 2024.

Housing starts rebounded in February, increasing by 10.7% to a 1.52 million annual rate, surpassing the expected consensus of 1.44 million. The surge in housing starts was largely influenced by poor weather in January that hindered construction throughout the month. On Thursday, existing home sales saw the largest increase in a year, rising by 9.5% in February to a 4.38 million annual rate, surpassing the expected consensus of 3.95 million. After two consecutive months of healthy increases, it appears that sales activity has finally bottomed out and is beginning to recover after two years of declines. Consumers are beginning to accept the current rates and not postponing home purchases.

On the employment front, initial jobless claims for last week remained at historically low levels, coming in at 210k, while the median forecast called for 213k.

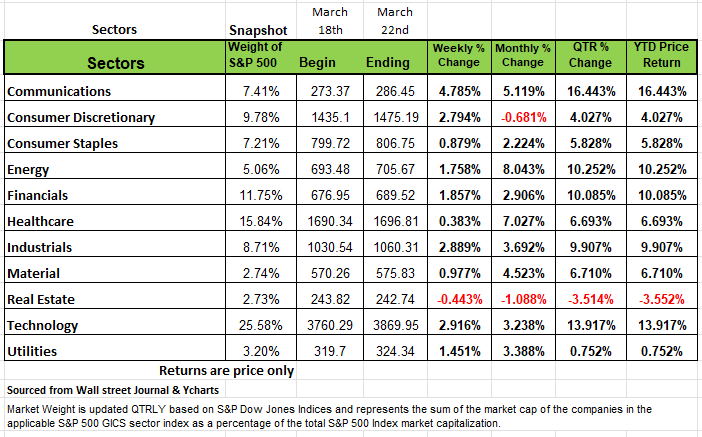

By Sector

All sectors in the S&P 500 rose in the week, except for Real Estate, which saw a decline of -0.43%, communication services, led the way, climbing +4.8% on the week. Technology and industrials rose +2.9% each, followed by a +2.8% increase in consumer discretionary and the remaining sectors Financial +1.85%, Energy +1.75% Utilities +1.45%. The rest preformed under one percent.

In communication services, Google parent Alphabet's (GOOGL) shares rose 6.8% amid an upbeat report by Wedbush. In the report, Wedbush raised its price target on Alphabet's stock to $175 per share from $160, saying perceived structural risks to Google Search have been overstated. The firm, which maintained an outperform rating on Alphabet's stock, also said Alphabet remains a "clear" beneficiary of generative artificial intelligence.

In the technology sector, Micron Technology (MU) shares jumped 18%. Several analyst firms raised their investment ratings and price targets on the semiconductor manufacturer's stock after the company said it swung to a profit in fiscal Q2 while revenue rose year-over-year. Micron also provided fiscal Q3 guidance for adjusted EPS and revenue that topped analyst expectations.

FedEx Corp also jumped after positive earnings releases, returning 12.25% last week. The package and freight company beat earnings estimates on slightly lower revenue as initiatives to lower structural costs helped improve profitability.

Other significant movers last week were Lululemon Athletica Inc. returned -13.28%, posting the worst performance in the S&P 500 Index. Though the company reported beating fourth quarter earnings, the stock declined on Friday on lower 2024 guidance which they attributed to the slowing of the US consumer.

The real estate sector's decliners included shares of Equinix (EQIX), which fell -5.8% as short-seller Hindenburg accused the company of manipulating its accounting. A representative for Equinix told MT Newswires that the company is "investigating the claims and will respond in due course."

This week, investors will be focused on a revised reading of Q4 gross domestic product, which is due Thursday, and the February personal consumption expenditures index on Friday. February new home sales are expected on Monday and February pending home sales on Thursday.

The U.S. Market

As equity valuations remain stretched out and earning estimates are lowered, quality seems to like it should be a key component in your portfolio, especially since we are in an environment of higher rates for longer.

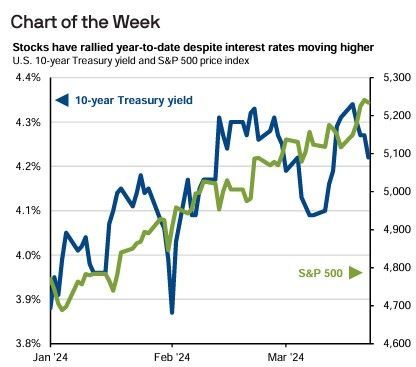

The yield to maturity on both the 10-year Treasury and 2 Year have increased more than 8% since the beginning of the year. Both have also remained above 4% since for most of the year so far. Over the same period, stocks have rallied 10% the (S&P 500 index) and some high-flying names like Nvidia which has returned 90% YTD have given some investors concerns that they are missing out and wanting to jump in at his point of the game thinking the momentum will continue. At first glance, this dynamic may seem counterintuitive, because high and rising interest rates are typically associated with weaker equity market performance. Historically they have been negatively correlated to one another. However, in today’s market, this relationship has changed, because of the resilient economic activity, accompanied by expectations for robust profit growth by companies.

Confidence in the market’s ability to continue returning strong numbers was reinforced after last week’s FOMC meeting, as the committee’s updates to its Summary of Economic Projections (SEP) illustrated a rosier economic outlook for 2024.

Real GDP growth projections were revised upwards from below-trend growth rates in December. The year-end unemployment rate forecast was revised downwards for 2024 and remained unchanged for 2025.

Headline PCE projections were left unchanged at 2.4% for the year-end 2024, but core PCE projections did increase slightly to 2.6%. Despite the increase in core PCE projections, in January headline and core PCE grew 2.4% and 2.8% y/y, respectively, highlighting that we are already close to meeting the FOMC’s expectations. The FOMC policy rate projections continued to signal three rate cuts in 2024 and a downward revised three cuts in 2025 as the economy and labor market are expected to remain healthy. However, this could all change quickly. Remember this is all based on best guess.

We still have some vulnerable issues that can impact the markets, besides the geopolitical dram in the middle East, Russia, China also present economic challenges. China has problems and they can only be buried for so long before it impacts the global economy. In addition, the consumer is still spending and it’s highly probable that we will see another bump-up in inflation data for the month of March next month which could cause the Fed to change its tone as well as the tone of the market.

So, depending on how invested you are in equities, the key takeaway should be that interest rates will likely stay higher for longer given the gradual pace of policy rate cuts laid out in the SEP.

In this environment of higher rates and return-to-trend growth (meaning 20% a year is not typical), quality will be key to sustaining portfolio value and stability, speculation should be conservative and justified. Investors should focus on attractively priced stocks with reliable revenue streams, sufficient cash flow, prudent cost management, with low interest rate exposure.

After years of underperformance mostly due to the low interest rates it’s likely that value stocks take the lead in 2024. Growth stocks have mostly fared worse than value stocks during periods of rising interest rates, largely due to those higher rates more severely discounting companies’ future earnings to their present values (conversely, this goes a long way towards explaining why growth stocks performed so well in the years before and during the pandemic, when interest rates were at or near rock bottom in many economies).

Value stocks are typically equities of companies with fundamental values not necessarily reflected by their share prices. Attractive value stocks tend to have lower price-to-earnings (P/E) ratios that are expected to rise once the market fully recognizes the company’s true worth. Sometimes these stocks can be found in undervalued companies that have fallen out of favor with investors perhaps they are not as sexy or given the media hype that many growth stocks receive, they tend to perform well following a broader market collapse/ correction but continue to exhibit solid fundamentals, as evidenced by such metrics as dividends, debt-to-equity ratios, and sales. In short, they are well-run companies trading at attractive discounts compared to their fundamentals. They tend to generate solid returns. For those familiar with Warren Buffet these are the types of companies Warren Buffets invest in.

Value stocks represent larger and more established companies compared with growth stocks. They also pay dividends more commonly than growth companies, as they don’t tend to reinvest all their retained earnings and may appear comparatively cheaper due to their undervaluation. While some investors believe that companies that pay dividends just do not have any good ideas for expanding their revenue, they tend to have lower volatility. So, in your appetite for risk is lower that the typical growth investor you may feel more comfortable being weighted in the asset class.

The dynamic future growth story is most often attributed to the narrative of a company, the so called “sizzle not the steak”. The focus is on the company delivering something new and/or innovative to the market, this is why tech start-ups have been the focus of growth stocks, as are more mature companies with earnings-growth rates that are expected to continue outpacing the market. Think google & amazon. Any cash generated by these companies is almost entirely committed back into the company, growth stocks seldom pay dividends to company shareholders. The companies are also under pressure to deliver on their promises and hit their benchmarks. The markets are not forgiving on any news that falls short of expectations.

Technical Perspective

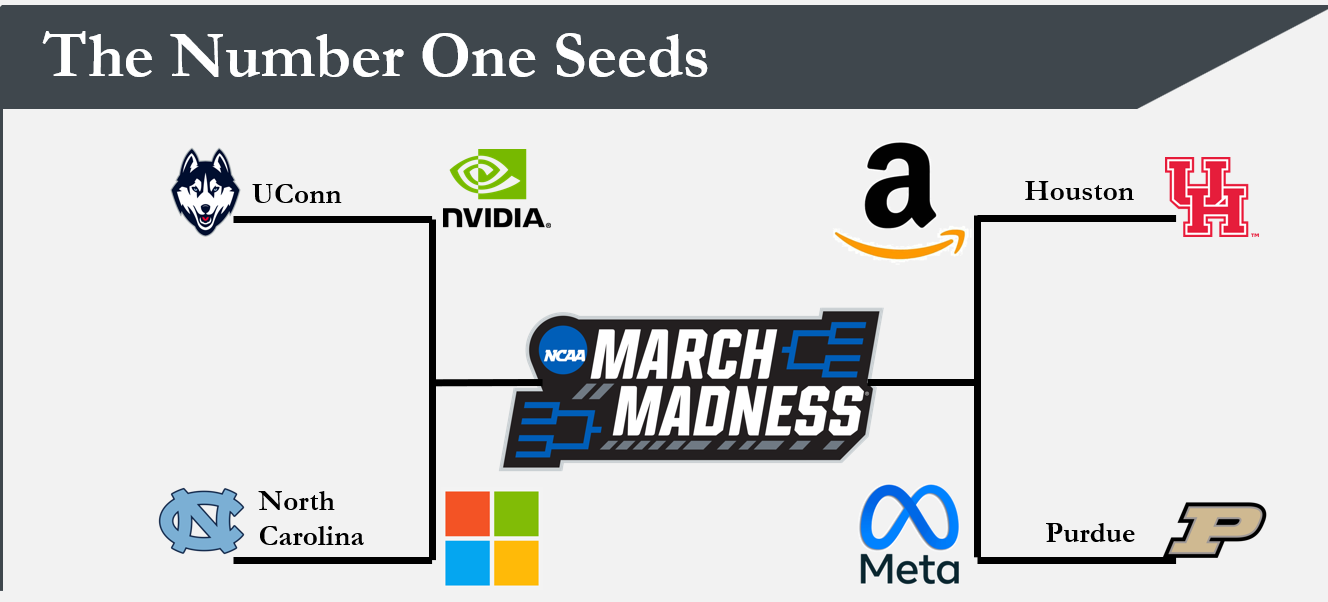

March Madness and the Markets

If you’re a basketball fan you probably have your favorites in the NCAA tournament. Many basketball experts have their favorites centered around Four powerhouse schools, University of Connecticut, North Carolina, University of Houston, and Purdue. The market also has its top picks that are driving the excitement of the market. These companies are Nvidia, Amazon, Microsoft, and Meta.

Last year’s tournament champion was UConn, in the markets it was Nvidia both top performers and so far in 2024 also the top performers the so-called Blue Blood. Nvidia has become the 3rd largest mover in the S&P 500

Houston and Perdue are household names both with consistent performance and excellent programs for future growth. These two would be equivalent to Amazon and Meta both also household names and were among the top performers in 2023 as well as YTD.

Lastly NC is much like Microsoft. Both are staples of consistency, both performed well in 2023 and are doing the same in 2024. All the companies are large mega cap technology stocks.

One company and school not listed not listed above are Kansa and Apple. Both have excellent programs. last year going into the tournament Kansas was the #1 seed. It has won the Big 12 conference in 17 of the last 19 seasons. This year, however, they were 6th seed in the Big 12 conference basically just making the tournament. Very much like Apple. Which was the first company to hit the trillion-dollar valuation market. Apple has had consistent growth over the years and is one of the few companies you felt comfortable having in your portfolio. Apple is the 2nd largest company in the S&P 500 and has outperformed the S&P index in 17 of the last 21 years. However, 2024 has not been a great year and so far it is down -10.3%.

Apple is trying to bounce off its “technical support line much like Kansas they are still in the game and will there be some March Magic help both Blue Blood institutions. Source Brandon Bischoff

The Week Ahead

The focal point of the data calendar will be Friday’s release of the core PCE inflation data – the Fed’s preferred measure of inflation. Since markets will be closed on Friday due to the Good Friday holiday, the reaction to the news won’t come until Monday. According to Bloomberg, core PCE during February is expected to dip to +0.3% from +0.4% in January. On a year-over-year basis, the estimate for core PCE is +2.8%, unchanged from the prior month. Other notable US data releases include the Conference Board's consumer confidence and durable goods orders on Tuesday. There are a handful of Fed Heads expected to speak this week, including Fed Chair Powell on Friday.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/