The Next Fed Chair

Newsletter

Week Ending Jan 23rd 2026

Market Recap

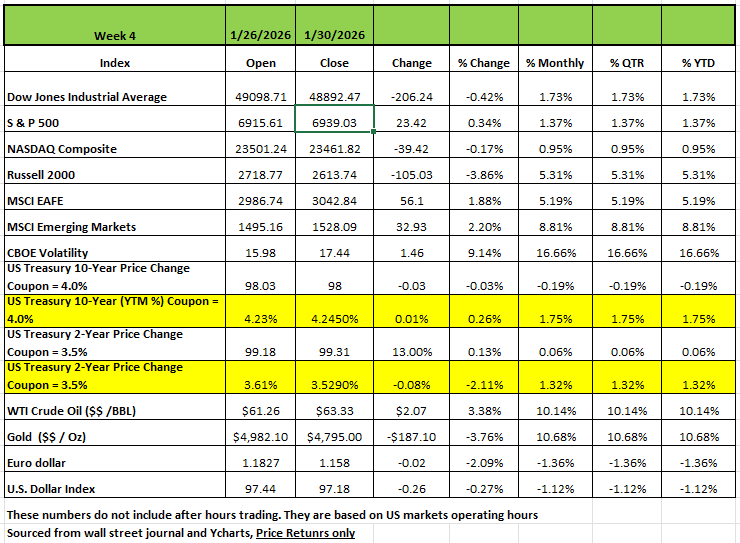

Last week was a fragmented week for equities; three of the 4 major indices ended the week in the red, with the S&P 500 being the lone winner by climbing +0.3%, after briefly touching a historic 7,000 before closing Friday at 6,939.03. The Russell 2000 had the largest decline with -3.86% on the week followed by the DOW -0.421% and the NASDAQ -0.17%

Earnings season hit its stride as 103 companies reported, including 36 mega-caps. To date for 4Q25 quarterly results, 81% of the 181 S&P 500 firms reported have topped estimates.

The slim move in the S&P 500 came as investors parsed through quarterly earnings reports. Better-than-expected results were posted by companies including Sandisk (SNDK) and Visa (V) while Tractor Supply (TSCO) was among those with weaker-than-forecast reports.

President Donald Trump's chose Kevin Warsh, who served as a governor on the central bank's board from 2006 to 2011, as head of the Federal Reserve. Before joining the Fed, Warsh was part of the George W. Bush White House and had worked at Morgan Stanley (MS).

Despite the ongoing political pressure, and another potential government shutdown the Federal Reserve held rates unchanged at the first meeting of 2026 on Wednesday, citing elevated inflation and a stabilizing labor market as reasons for their decision.

In other economic news, new orders for durable goods rose 5.3% in November, beating the consensus expected 4.0%. November’s trade deficit came in at $56.8 billion, much larger than the consensus expected $44.0 billion. Exports fell by $10.9 billion while imports rose by $16.8 billion. The Producer Price Index (PPI) rose 0.5% in December, coming in above the consensus 0.2%. Producer prices are now up 3.0%

By Sector

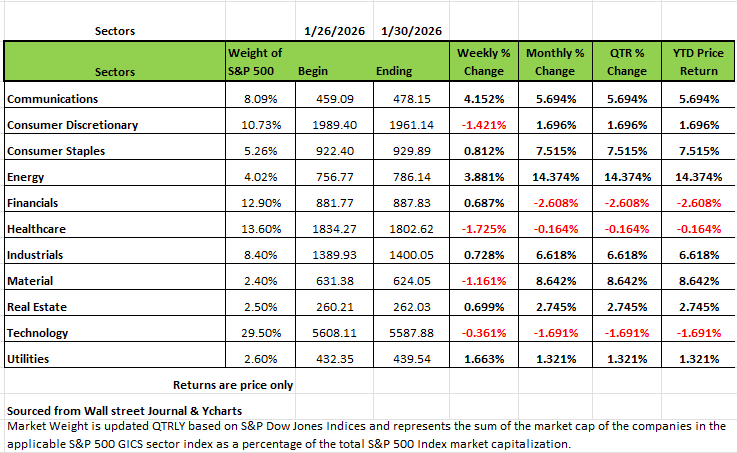

Seven of the 11 sectors all posted positive returns with communication services having the largest percentage gain this week, climbing +4.2%, followed by a +3.9% increase in energy and a +1.7% advance in utilities. Consumer staples, financials, industrials, real estate and financials also edged higher.

Verizon Communications (VZ) and AT&T (T) led the gains in communication services as they reported Q4 adjusted earnings per share and revenue above analysts' expectations. Both companies also forecast 2026 adjusted EPS above analysts' mean estimate. Verizon's shares jumped 13% on the week while AT&T climbed 11%.

The advance in the energy sector came as crude oil futures reached a four-month high this week amid geopolitical tensions. Chevron (CVX) and Exxon Mobil (XOM) were among the sector's best performers as both companies reported better-than-expected fourth-quarter results amid higher oil output. Chevron's shares rose 6.1% on the week while Exxon Mobil added 4.8%.

On the downside, healthcare had the largest percentage loss of the week, shedding -1.7%, followed by a -1.4% decline in consumer discretionary and a -1.2% decrease in materials. Technology also edged down -0.4%.

UnitedHealth Group (UNH) was among the health care sector's hardest-hit stocks, tumbling -19% amid mixed fourth-quarter results. The company's earnings topped market expectations, but revenue fell short of estimates, and the health insurance company forecast 2026 revenue below analysts' expectations. The administration also announces the lowest increase in Medicare reimbursements sending other Medicare companies stocks down.

Next week's earnings calendar features Walt Disney (DIS), Advanced Micro Devices (AMD), Merck (MRK), Pepsico (PEP), Alphabet (GOOG, GOOGL), Eli Lilly (LLY), Amazon.com (AMZN), ConocoPhillips (COP) and Philip Morris International (PM).

On the economic front, investors will be focused on the government's January jobs report, which is due Friday. Other economic data will include January auto sales on Monday and a preliminary reading on February consumer sentiment on Friday.

The Next Fed Chairman

Last week, the President officially nominated Kevin Warsh to succeed Jerome Powell as Chair of the Federal Reserve on May 15th. Warsh, has the experience as a former Fed Governor during the Bush II and Obama administration (2006–2011) as well as being an executive at Morgan Stanley, He appears to be the pick that will bridge the gap between traditional institutionalism and Trump’s "regime change" agenda for the central bank. Good or bad we will find out how it impacts the country.

The Warsh Track Record: Hawk turned "Strategic Dove"

Historically, Warsh was known as an inflation hawk. During the 2008 financial crisis, he frequently warned that keeping rates too low for too long would spark runaway inflation, a prediction that never materialized. However, his recent "audition" for the role suggests a change of mindset:

His rationale is that the that the AI revolution is a "disinflationary force." He suggests that the Fed can afford to lower rates because AI-driven productivity gains will keep prices stable even as the economy accelerates. He may be correct. During the decade of near zero interest rates inflation was kept in check and technology helped bring efficiency to businesses as well as information so companies could react quicker to changes. In fact, the period between 2009 and 2020 was the longest in U.S. history without a recession.

While he may be "dovish" on interest rates (favoring cuts), he is "hawkish" on Fed’s footprint. He has been a vocal critic of the Fed’s massive balance sheet and is expected to push for a significant reduction in bond holdings. When the Fed shrinks its balance sheet, it is essentially removing digital cash from the banking system. The Fed doesn't usually "sell" its bonds. Instead, it lets them "roll off." When a bond it owns matures, the Fed simply doesn't buy a new one. The Treasury then has to find a private buyer (like a bank or a hedge fund) to buy the new debt instead. The Result: The money used by that private buyer is "vacuumed" out of the financial system and disappears from the money supply. This makes cash "scarcer" and more expensive. The stock market generally hates a shrinking balance sheet because it removes the "safety net" of excess cash.

The biggest risk of shrinking the balance sheet is that the Fed goes too far and creates a liquidity crunch.

Back in September 2019, the Fed shrank its balance sheet so much that banks ran out of "spare" cash to lend each other overnight. Interest rates in the "Repo Market" spiked to 10% in hours, forcing the Fed to abruptly stop QT and start pumping money back in.

Nominees like Kevin Warsh have argued for a "leaner" balance sheet to reduce the Fed’s influence over Wall Street. However, the challenge is finding the "floor" the minimum amount of reserves needed to keep the global financial plumbing from freezing up.

Warsh has called for the Fed to "abandon the dogma" of current economic models, specifically criticizing the idea that a strong labor market naturally causes inflation. The Phillips Curve. For decades, the Federal Reserve has operated on the belief that there is a direct "trade-off" between unemployment and inflation. Warsh argues that this model is outdated a piece of "dogma" that prevents the economy from reaching its full potential.

Market Outlook: 2nd Half of 2026

The transition in May sets the stage for a volatile but potentially "pro-growth" second half of the year. Here is what the market is pricing in based on a Warsh-led Fed:

The "Warsh Put" vs. The Independence Risk

Investors are weighing the benefit of lower rates against the risk of political interference. If Warsh follows the White House’s lead to cut rates aggressively in H2 2026, it could fuel a "melt-up" in equities, particularly for capital-intensive sectors like tech and real estate. However, if the market perceives he is sacrificing the Fed's independence, we may see a "risk premium" added to long-term bond yields.

Commodities: Gold and Silver Volatility

The announcement already caused a sharp correction in precious metals. Gold and silver, which thrived on uncertainty and a weaker dollar in 2025, faced double-digit drops as the dollar regained strength on the news. Expect continued pressure on "safe-haven" assets if Warsh successfully projects a "stable dollar" policy.

A Shift in the "Dual Mandate"

With the labor market showing signs of slowing in early 2026, a Warsh-led Fed is likely to prioritize growth and deregulation over the strict 2% inflation target. This could lead to a "Goldilocks" scenario for the S&P 500 in the 2H lower borrowing costs paired with a pro-business regulatory environment provided that the "one-off" inflationary effects of new tariffs begin to fade.

The Balance Sheet "Wildcard"

If Warsh aggressively shrinks the Fed’s balance sheet while cutting the Fed Funds Rate, we could see a steepening of the yield curve. Short-term rates would fall, but long-term rates (which affect mortgages) might stay stubborn or rise as the Fed stops buying bonds. This would negatively impact home prices and we know how much of our economy is linked to housing. If home prices crash the wealth that many Americans have tied up in their homes would be affected.

The Week Ahead

Amid all the market-moving news that came out last week, investors once again confronted the risk of at least a partial government shutdown. Lawmakers strived to agree on a spending bill by last Friday’s midnight deadline while also negotiating limits on immigration enforcement. Meanwhile, another heavy dose of earnings announcements, U.S. jobs data, and several central bank decisions are on tap for this week. Mega caps Alphabet and Amazon are set to report, along with other key technology companies like Advanced Micro Devices, Palantir, NXP Semiconductor, and Qualcomm. Friday’s non-farm payrolls release is expected to show gains of around 70,000

jobs in January, and based on last week’s FOMC statement, solid economic growth seems to have eased some labor market concerns. The rest of the U.S. calendar includes February’s preliminary consumer sentiment reading and ISM manufacturing and services PMIs. Overseas, interest rate decisions arrive this week from central banks in the UK, Europe, and Australia. The BoE and the ECB are expected to keep rates level, while the Reserve Bank of Australia may consider a hike after Q4 inflation rose to 3.6% YoY. Money markets are pricing in around a 70% probability of such a move. Crude oil prices jumped more than 7% last week as tensions between the U.S. and Iran

continued to rise, and OPEC was expected to keep its pause on output increases in place when it met over the weekend.