Fear or FOMO

Newsletter

Week Ending Jan 16th 2026

Market Recap

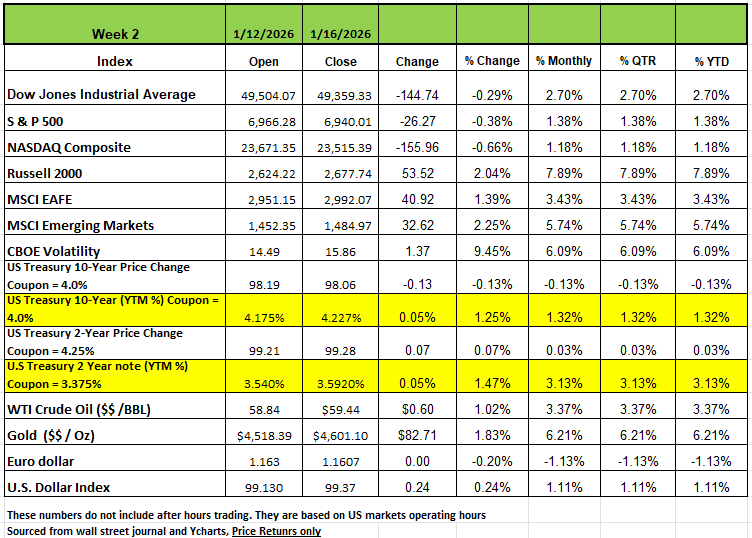

Three of the four major indices edged down last week with the Russell 2000 being the lone index posting a +2.04% gain on the week. The S&P 500 index edged down -0.4% the DOW -0.29% and NASDAQ -0.38%. Last week kicked off earning season with several big banks posting weaker-than-expected revenue.

JPMorgan Chase (JPM), Wells Fargo (WFC) and Citigroup (C) were among the banks that disappointed investors last week. JPMorgan and Wells Fargo both surpassed expectations for Q4 adjusted earnings per share but revenue missed Street views amid declines in investment banking segment of their business. Citigroup, meanwhile, missed expectations on both the top and bottom lines.

JPMorgan CEO Jamie Dimon issued a warning that "markets seem to underappreciate the potential hazards - including from complex geopolitical conditions, the risk of sticky inflation and elevated asset prices." As of the writing of this newsletter, the markets and down a little more than -1% to start off the second week of 2026 with concerns of the administrations position on putting tariffs on those countries that do not support the U.S taking over Greenland.

The Consumer Price Index (CPI) rose 2.7% in December from a year earlier, matching expectations. Although still elevated, December’s increase marks an improvement from last year’s 2.9% pace. The core CPI, which excludes food and energy, increased 2.6%, matching the lowest year-over-year gain in more than four years and coming in below forecasts. The market’s reaction to the report was muted, with Treasury yields and rate-cut expectations largely unchanged. Producer prices increased in line with expectations in both October and November. Meanwhile, the housing market showed signs of life based on data released last week. Both new and existing home sales exceeded expectations, supported by gradually easing mortgage rates, lower prices, and builder incentives. Existing home sales rose in each of the final four months to close out the year. November retail sales topped expectations, posting broad-based gains. However, November’s gain reflected a rebound in auto sales following the expiration of the EV tax credit in October

By Sector

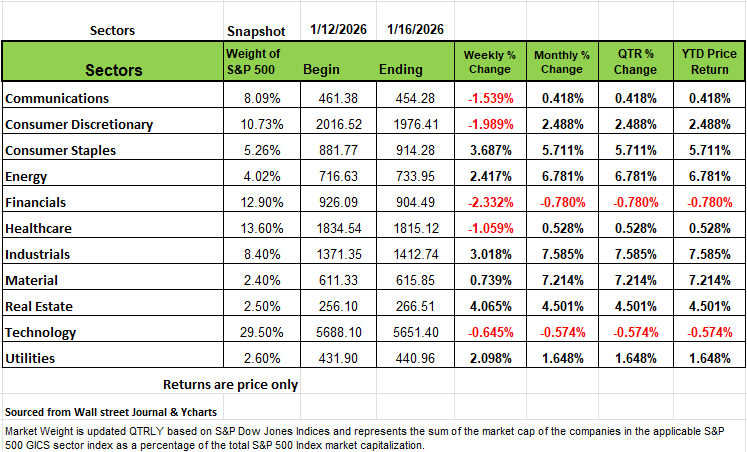

On the Sector side 6 of the 11 sectors in the S&P index posted positive returns on the week, with Real Estate sector up +4.065%, followed by Consumer Staples +3.68%, Industrials +3.01%, Energy +2.41% and Utilities +2.09% The financial sector had the largest percentage drop on the week, falling -2.3%, followed by a -2% decline in Consumer Discretionary and a -1.5% slip in Communication services. Healthcare -1.05% and technology -0.64% also edged lower.

In the financial sector, Wells Fargo (WFC) was among the top decliners with a 7.9% loss amid its weaker-than-expected Q4 revenue. Wells Fargo's Q4 corporate and investment banking revenue edged up to $4.62 billion from $4.61 billion in the prior year quarter, but was weighed down by a 7% decline in investment banking.

Cruise operators were among the hardest-hit stocks in consumer discretionary, with Royal Caribbean Group (RCL) shares falling 11% and Norwegian Cruise Line Holdings (NCLH) and Carnival (CCL) slipping 10% each.

Top gainers in real estate included shares of Crown Castle (CCI), which climbed 8.6% as the company ended its infrastructure agreement with DISH Wireless after default on payments to the company. Crown Castle exercised its right to shares of terminate the agreement and recover over $3.5 billion in payments owed. Other winners in the sector were with American Tower (AMT) posting a +8.94% CoStar Group (CSGP) +11.71 Extra Space Storage +6.95% and Iron Mountain (IRM) +7.5 increase

Earnings reports expected next week include Netflix (NFLX), 3M (MMM), US Bancorp (USB), Johnson & Johnson (JNJ), Charles Schwab (SCHW), Procter & Gamble (PG), GE Aerospace (GS), Abbott Laboratories (ABT) and Intel (INTC).

Fear or FOMO (Fear of Missing Out)

As we begin 2026, we are seeing that Investor sentiment is dominated by a strange mix of FOMO and FEAR: investors are anxious about missing further upside, yet equally worried that the next big move could finally be a meaningful correction or crash like 2001 or 2008. This tension is being amplified by the AI trade, stretched valuations, and a stark generational divide in how investors process risk and opportunity.

The current mood: late‑cycle optimism with correction anxiety

Individual investors have turned notably more optimistic into 2026, with recent surveys showing a marked jump in bullish sentiment and a retreat in outright bearishness. Yet even as optimism rises, conversations consistently circle back to the same question: “Am I too late—and what happens when this finally breaks?”

That push‑pull shows up in positioning: investors remain largely invested, but often with one foot out the door—holding extra cash at the margin, hesitating to rebalance, and clustering in what has worked, especially mega‑cap tech and AI‑linked names.

AI, FOMO, and the central‑bank view

The AI‑driven rally has become the focal point of this cycle’s FOMO. A small group of U.S. “hyperscalers” and AI beneficiaries now carry an outsized share of global index performance, creating both concentration risk and a powerful narrative that “sitting out AI” means structurally underperforming.

The European Central Bank’s November 2025 Financial Stability Review explicitly warns that “stretched” AI‑related valuations appear increasingly influenced by fear of missing out, not just earnings fundamentals. The ECB draws parallels to past tech booms, noting that while current earnings strength partially justifies high prices, sentiment could reverse abruptly if AI earnings or growth disappoint.

The ECB’s concern is not simply price level, but the combination of FOMO‑driven flows, leverage, and liquidity mismatches in non‑bank financial intermediaries, which could amplify any AI‑related drawdown into a broader episode of stress. (Source https://www.cnbc.com/2025/12/02/fear-of-missing-out-may-be-fueling-ai-rally-says-ecb.html)

The generational split in sentiment

The emotional mix of FOMO and fear is not evenly distributed across the investing population; it breaks sharply along age and cohort lines.

Surveys show that nearly 70% of Gen Z report experiencing financial FOMO, compared with about 57% of Millennials and Gen X and only 28% of Baby Boomers. Younger investors are more likely to say they have made investments specifically because of FOMO, especially in crypto, meme stocks, and high‑beta AI‑linked names.

Gen Z and younger Millennials are also far more likely to rely on social media, influencers, and peers for investment information, which means they live in a constant stream of screenshots, “gain porn,” and viral narratives that normalize aggressive risk‑taking and rapid trading. This environment magnifies both the excitement of momentum and the anxiety of being left behind.

Older cohorts, particularly Boomers, report much lower levels of FOMO and exhibit greater baseline risk aversion, even controlling for wealth and education. Their dominant fear is less “missing the next AI 5‑bagger” and more “living through another 2000 or 2008‑style drawdown again right before or during retirement.”

How age shapes FOMO vs. fear

Gen Z and younger Millennials tend to express their FOMO directly in allocation choices: higher willingness to trade frequently, concentrated positions in volatile themes, and a belief that long time horizons justify taking big swings. For them, the primary anxiety is being underinvested in the “next big thing,” not the path of volatility between here and there.

Gen X and older Millennials often sit in the middle: they understand the long‑term power of secular themes like AI but are more conscious of sequence‑of‑returns risk, college and retirement funding, and the memory of prior bubbles. Their fear tends to express itself as hesitation—knowing they “should” stay invested, but second‑guessing new money allocations at elevated prices. (Source https://www.kiplinger.com/investing/how-different-generations-invest-and-what-they-can-teach-you)

Boomers’ typically have lower FOMO and higher risk aversion mean they are less likely to chase, but when they do feel they have “missed it,” the temptation can be to capitulate late in the cycle—overriding years of discipline in one emotional decision. This fear is heavily tied to capital preservation and avoiding a large drawdown that would materially alter lifestyle.

What this sentiment mix means for portfolios

From a portfolio‑construction standpoint, the coexistence of FOMO and fear across generations tends to produce three observable patterns:

Crowded winners and neglected hedges: AI‑centric leaders, quality growth, and perceived “can’t‑miss” themes attract disproportionate flows, while hedges—diversifiers, value, small caps, non‑U.S. equities—struggle to attract enthusiasm even when valuations are more forgiving. This asymmetry will leave portfolios more fragile when the leadership regime shifts. (It always shifts).

Under‑rebalancing in both directions: Younger investors may resist trimming winners because doing so “admits” that the party might end, while older investors may resist buying into weakness for fear that a pullback is the start of something worse. In both cases, the emotional overlay distorts what should be a rules‑based rebalancing process.

Liquidity illusions in hot themes: FOMO capital often finds its way into structures that look liquid on the surface—daily‑dealing funds, structured products, or high‑beta ETFs—but are ultimately backed by crowded trades or less‑liquid underlying securities. That can matter if sentiment on AI or broader equities turns, particularly for intermediaries using leverage.

Given the current backdrop, if you have a financial advisor, effective communication is less about predicting the next 10–15% move and more about channeling powerful emotions into a consistent framework. The message needs to be tailored by age and life stage.

With younger clients, the focus is on time horizons and position sizing. The goal is not to extinguish enthusiasm for AI or innovative themes, but to ring‑fence it: size speculative ideas modestly, avoid leverage, and anchor the bulk of wealth in diversified, long‑term exposures that do not depend on perfectly timing a narrow trade.

With mid‑career investors, the emphasis shifts to sequence risk and resilience. Here, showing how a disciplined rebalancing policy can systematically “buy fear and sell FOMO” the Warren Buffett philosophy, over time, this helps transform anxiety about corrections into a concrete process.

With pre‑retirees and retirees, the priority is to separate lifestyle security from market narratives. The focus should be on consistent income revenue. A portfolio that needs to be liquidated on a monthly or quarterly basis to meet your income needs runs the risk of selling a security at a correction level, which ultimately requires the selling more positions to meet income needs, so even a rebound will not offset the number of extra positions that were sold off.

Underneath all of this sits a simple reality: markets can rally further from here, and they can correct meaningfully from here, and investors have virtually no control over which comes first. What they can control is how much of their decision‑making is outsourced to FOMO or fear—and how much is governed by a clear, written plan for risk, time horizon, and behavior when the headlines finally shift from euphoria to stress.

The Week Ahead