The Fed in 2026: New Faces, New Chair, New Direction?

This article is provided by Gene Witt of Optimized Capital LLC. for general informational purposes only. It is an opinion, not investment advice This information is not considered to be an offer to buy or sell any securities or investments and is not to be considered investment advice. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. Optimized Capital Registered Investment Adviser (RIA) that maintains a principal place of business in the State of Illinois and Indiana. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements

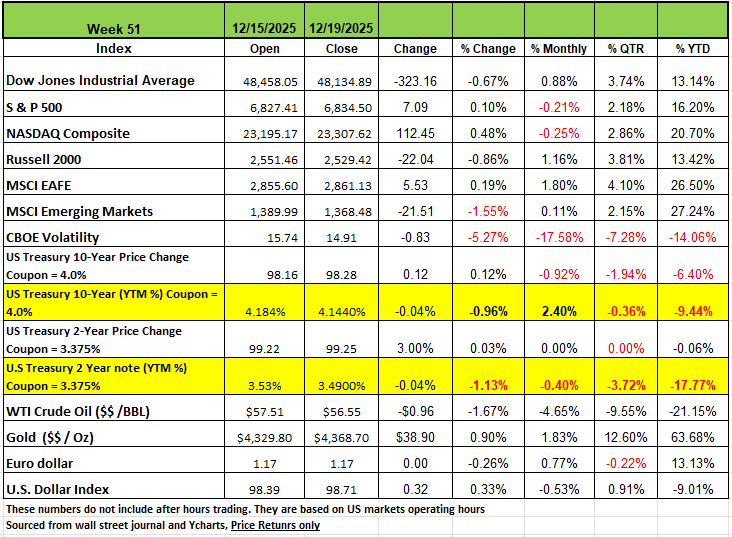

Market Recap

As we enter into the last two weeks of 2025, the markets seem to be holding steady with all of the potential issues both domestically and globally. Two of the 4 major indices closed the week ending Dec 19th positive, and two closed the week down. The DOW declined by a little more than 300 points for a -0.67% drop over the previous week. The Russell 2000 declined -0.86%

The S&P 500 index edged up 0.1% this week as gains led by the consumer discretionary sector managed to outweigh energy-led declines. The market benchmark ended Friday's session at 6,834.50, down slightly -0.2% for the month but up +16% for the year.

Investors received a mixed bag of economic data this week, including reports that had been delayed by the government shutdown. The US economy added 64,000 jobs in November, beating estimates, and the unemployment rate ticked up to 4.6% from 4.4% in September. The October unemployment rate will not be released due to the government shutdown. Tuesday’s report also showed that the US lost 105,000 jobs in October, which was the largest loss since 2020. However, the contraction was due to a decline in federal government employees that is unrelated to the government shutdown. Private-sector payrolls grew in both November and October. Retail sales were unchanged in October. However, sales grew 0.5% excluding car dealers and gas stations, where the expiration of the EV tax credit weighed on sales. New inflation data showed the core Consumer Price Index, which excludes food and energy, rose +2.6% in November from a year ago. That was the slowest pace since 2021. The headline CPI increased +2.7%. Both were lower than expected. The data was affected by the government shutdown, leading to questions about the magnitude of the slowdown, but it showed inflation cooled, nonetheless. Treasury yields fell on the report, which offered inflation relief.

By Sector

Consumer discretionary was the strongest sector in the S&P 500 this week, climbing 1%, followed by gains of 0.6% each in materials and health care. Technology and communication services also edged higher. Carnival (CCL) shares jumped 13%, the largest weekly percentage increase among consumer discretionary stocks. The cruise operator reported fiscal Q4 earnings that topped analysts' estimates and reinstated its quarterly dividend.

Albemarle (ALB) topped the materials sector's gainers, climbing 9.9% amid a number of positive analyst actions. Morgan Stanley upgraded its investment rating on the stock to equal weight from underweight while boosting its price target to $147 per share from $58. Analysts at BMO Capital, RBC Capital, Citigroup, Mizuho, and Wells Fargo also increased their price targets on Albemarle's stock.

In health care, Incyte (INCY) was among the top gainers, rising 7.6%. The company said the European Commission has approved Monjuvi in combination with lenalidomide and rituximab for the treatment of adults with relapsed or refractory follicular lymphoma after at least one prior therapy.

On the downside, energy fell 2.9%, followed by a 1.4% loss in real estate and a 0.9% drop in consumer staples. Industrials, utilities, and financials also edged lower.

The energy sector's drop came as crude oil prices fell. Marathon Petroleum (MPC) had the largest weekly percentage drop in the sector, falling 9.4%. The company said it hired Maria Khoury as chief financial officer, starting Jan. 19. Khoury, who is joining Marathon Petroleum from Danaher, will succeed John Quaid, who will remain at Marathon Petroleum for a transitional period.

Next week's US stock trading will be shortened by the Christmas holiday. The market will close several hours early on Wednesday and will be closed all day on Thursday. A full day of trading resumes on Friday Dec 26th.

Economic data will be light amid the holiday closures, but a delayed report on Q3 gross domestic product is expected on Tuesday. December consumer confidence is also scheduled for Tuesday

The Fed in 2026: New Faces, New Chair, New Direction?

As we peer into the 2026 economic landscape, the Federal Open Market Committee (FOMC) is bracing for its most significant transformation in years. With Jerome Powell’s term as Chair officially ending in May 2026, the focus has shifted from "if" the Fed will cut rates to "who" will be leading the charge and how a refreshed voting roster will influence the cost of borrowing.

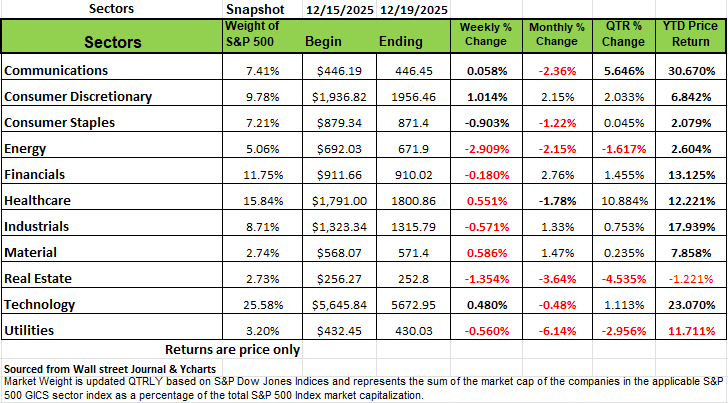

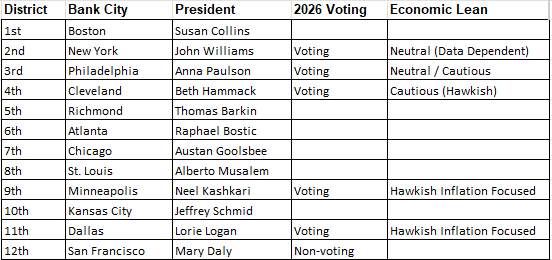

While the headlines focus on the "Fed Chair," the central bank is actually governed by 19 distinct individuals. These leaders are split into two groups, each with different ways of influencing your interest rates:

The Board of Governors (7 Members): Based in Washington, D.C., these are presidential appointees who serve 14-year terms. They hold permanent voting rights on the Federal Open Market Committee (FOMC)

The governors include

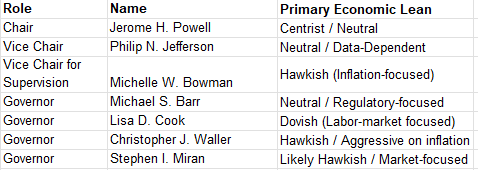

There are 12 Regional Bank Presidents, one for each of the Federal Reserve Districts (Boston, New York, Chicago, etc.). These individuals are technically employees of their specific regional banks, not the federal government. While they all participate in the meetings, not all vote each year. There is a rotation from one year to the next as to which regional bank can cast a vote.

Key Shifts at the End of 2025

As 2025 draws to a close, two major organizational events have recently occurred that will impact the 2026 landscape :

Mass Reappointment

On December 11, 2025, the Board of Governors (including Trump-appointees Waller, Bowman, and Miran) voted unanimously to reappoint 11 of the 12 regional presidents to new five-year terms. This move was seen as a major effort to ensure institutional stability and Fed independence heading into the 2026 leadership transition.

The Atlanta Vacancy: The only president not reappointed was Raphael Bostic (Atlanta), who announced his retirement effective February 2026. Cheryl Venable (currently First Vice President) will take over as interim president of the Atlanta Fed until a permanent successor is found.

The 2025 regional voters (Collins, Goolsbee, Musalem, and Schmid) oversaw a period of cooling inflation and the beginning of a rate-cutting cycle. Austan Goolsbee was notably the most vocal proponent for easing policy to protect the labor market, while Jeffrey Schmid remained the more cautious "hawk" of the voting group.

The 2026 Voting Roster: The Rise of the Hawks

In January 2026, the FOMC voting power rotates to new group of regional presidents. While the Board of Governors often follows the Chair’s lead, the four rotating regional presidents for 2026—Hammack, Paulson, Logan, and Kashkari—have all recently voiced concerns about cutting rates too quickly in the face of persistent "sticky" inflation. This could make the number of rate cuts less likely if inflation does not see significant improvement.

The "Shadow Chair" Dilemma: What’s Jerome Powell’s next move?

Jerome Powell’s term as Chair officially ends in May 2026. While President Trump is expected to nominate a successor—with names like Hassett (Dovish) and Warsh (Hawkish) topping the list—Powell faces a unique choice. Powell’s term as a Governor does not expire until January 31, 2028. Legally, he can remain on the Board even after he is replaced as Chair of the Fed.

So, what does that mean? If Powell stays, he remains a permanent voting member. This could create a "Shadow Chair" scenario where the former leader continues to influence policy, potentially clashing with his successor's agenda. The media would love to see Powell stay on and sensationalize possible conflicts if the Fed decision does not align with the media or President. Historically, most Chairs resign entirely when replaced, but because Powell has remained silent on his plans, it is causing speculation that he may stay to "guard" the Fed’s independence. We think that Powell is too much of a class act and will exit gracefully.

President Trump is expected to name Jerome Powell's successor soon to ensure a smooth transition. Currently, the shortlist has narrowed down to a few frontrunners who represent a potential shift in how the Fed communicates with the White House

Kevin Hassett: Currently the Director of the National Economic Council. Hassett is viewed as the most "dovish" candidate, frequently advocating for lower interest rates to spur productivity and capital growth.

Kevin Warsh: A former Fed Governor with deep ties to the financial world. Warsh is respected by markets but is often viewed as more "hawkish" on fiscal discipline compared to Hassett.

Christopher Waller: A current Fed Governor who has been "right" on many of the recent inflation calls. He represents a "continuity" pick but has shown he isn’t afraid to lean toward cuts if the labor market softens

The Interest Rate Outlook: Stagflation vs. Growth

The consensus among the current Committee members (the "Dot Plot") suggests only one 25-basis-point cut in 2026, targeting a federal funds rate of roughly 3.25% to 3.5%. However, the incoming administration has expressed a desire for much lower rates (closer to 1%). This may create a "no-win" scenario for the new Chair:

Cut aggressively to satisfy political pressure, risking a resurgence of inflation.

Hold steady to maintain Fed independence, risking a public clash with the White House.

What This Means for Investors

Investors should prepare for increased volatility throughout 2026. The combination of a new Chair and a more cautious voting bloc of regional presidents means that the "path to neutral" for interest rates will likely be bumpier and slower than many hope. The media and the markets will continue to focus on the monthly data points as a sign of the direction of the Fed interest rate moves. Affordability will be at the forefront of conversation in 2026 and with mid-term elections in November, we expect to see a slew of negative advertising by mid-year. As the probability markets grow more popular, they will be predicting election outcomes by district and anything in favor of the Democratic party gaining control of Congress will mean that Congress will do whatever it can to prevent Trump from completing his agenda. Markets will respond accordingly.

A Technical Perspective

Technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can accurately predict the bottom and peak prices of a security, technical analysis attempts to identify opportunities near these levels.

U.S. consumer sentiment surveys have reflected a consistent theme in 2025: rising expenses. Falling oil prices, which have led to cheaper gasoline, have been the one exception and a bright spot for consumers. Since peaking at over $130 when war broke out in Ukraine in early 2022, oil has been in a steady downtrend. Looking at the S&P GSCI Crude Oil index ($SPGSCL), which tracks crude oil futures, technical support near $355 (around $65 per barrel on crude itself) held for several years. Each subsequent rally stalled out at consistently lower highs, creating a long

and wide descending triangle technical pattern, which often precedes a break of support. That support held until the tariff scare in April. After the tariffs were paused in early June, oil attempted a bullish reversal but failed at the down-sloping trendline, eventually falling to nearly five-year lows. Fears of oversupply have put continuous pressure on oil prices, outweighing geopolitical concerns. Reserves sitting on oil tankers are up 30% since August, and suppliers are reducing ship speeds since their destinations already have ample product. Barring shifts in macroeconomic factors, 2026 may continue to bring consumers some relief in the cost of petroleum-based goods.