The Tokenization Revolution

This article is provided by Gene Witt of Optimized Capital LLC. for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments or to be considered investment advice. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors, including personal goals, needs and risk tolerance. Optimized Capital Registered Investment Adviser (RIA) that maintains a principal place of business in the State of Illinois and Indiana. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements

Market Recap

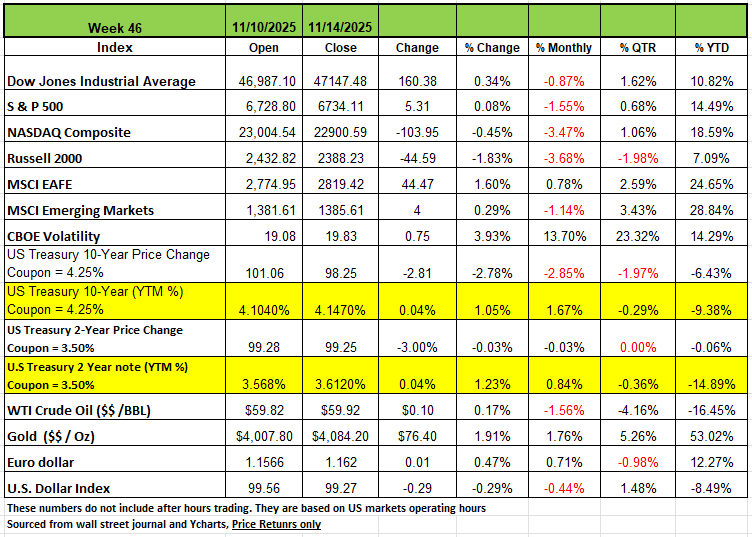

Two of the 4 major indices posted negative returns last week The DOW was up 0.34% and the S&P 500 index edged up 0.1% last week as gains led by health care and energy stocks slightly outweighed declines in sectors including consumer discretionary and utilities.

The market benchmark ended Friday's session at 6,734.11 and is still in the red for November with a month-to-date drop of 1.6%. The index is up 14% for the year.

This week featured the end of a 43-day government shutdown, the longest federal closure in US history. While the government has reopened, investors are still awaiting the resumption of a number of key economic reports including employment data for September, which is scheduled to be released on Nov. 20, and October. As earnings season winds down, questions loom over what the delayed economic reports may show and how they may impact the Federal Reserve's policy-setting meeting in December.

Treasury yields rose slightly-to-moderately over the course of the week on the end of the government shutdown and speculation that the Federal Reserve Bank would not cut interest rates as aggressively as previously expected. The market began the week with an optimistic outlook as reports surfaced of a deal between the parties to fund and reopen the government, ending weeks of uncertainty as to how the shutdown would impact the economy. The legislation was officially passed and signed on Wednesday, opening the government, as traders will now look to a backlog of economic reports, that were previously on hold, to shed light on the upcoming rate decision for the Fed. However, that optimism turned to pessimism on Thursday on more hawkish comments from Fed officials. Two separate Fed Presidents said that the bank should “move cautiously on rates” and be “somewhat restrictive” while another is undecided on the December cut after being against a cut last time. A number of Fed officials are still worried about job weakness and the Fed may have to wait for the economic data that was delayed by the shutdown. The market implied probability of a cut to the Federal Funds Rate at the December 10th meeting dropped from 66% to 43% over the course of the week while the market implied end of 2026 rate rose from 3.04 to 3.08.

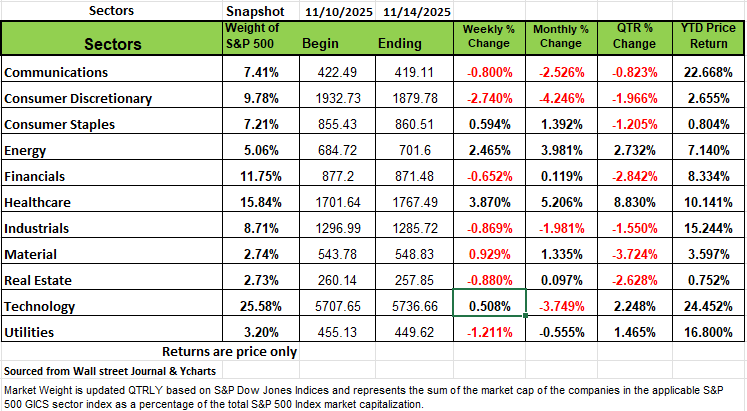

By Sector

The healthcare sector had the largest percentage increase this week, climbing 3.9%, followed by a 2.5% rise in energy and a 0.9% increase in materials. The consumer staples and technology sectors also eked out weekly gains. Eli Lilly (LLY) was the best performer in health care, rising 11% on the week amid news the company will be partnering with MeiraGTx (MGTX) to develop and commercialize genetic therapies for eye diseases. Under the companies' agreement, MeiraGTx will give Eli Lilly global rights to its AAV-AIPL1 program, which targets Leber congenital amaurosis 4, a severe inherited eye disorder. Leerink Partners upgraded its investment rating on Eli Lilly's stock to outperform from market perform.

The energy sector's top gainer was Devon Energy (DVN), which rose 6.4% on the week in the continued aftermath of its better-than-expected Q3 report last week. Devon Energy is positioned to deliver stable operations in 2026 while benefiting from improved capital efficiency and ongoing optimization, RBC Capital Markets said Tuesday in a report.

On the downside, consumer discretionary fell 2.7%, followed by a 1.2% drop in utilities and declines of 0.9% each in real estate and industrials. Communication services and financials also edged lower.

Williams-Sonoma (WSM) had the largest percentage drop in the consumer discretionary sector this week, falling 7.5%. This comes ahead of the company's next quarterly report, which is set to be released on Wednesday, Nov. 19.

Other companies set to release quarterly results next week include Home Depot (HD), Medtronic (MDT), NVIDIA (NVDA), TJX (TJX), Palo Alto Networks (PANW), Lowe's (LOW), Target (TGT), Walmart (WMT), Intuit (INTU) and BJ's Wholesale Club (BJ).

Beyond the Nov. 20 release of September employment data, the schedule of economic reports remains unclear as the government works to resume releasing data following its 43-day shutdown.

The Tokenization Revolution

When Digital Assets Meet Reality's Hard Edges

The Promise: Everything Becomes Liquid

Anyone that has listened to the financial markets in the morning has surely heard advertisers touting real estate investments that are tied to Bitcoin or some other crypto currency. So exactly what are they doing? They are tokenizing the investment. Like all new products that hit the financial markets there are some good and dangerous sides to this. So what exactly is tokenization?

Tokenization—the process of converting rights to an asset into a digital token on a blockchain, which promises to revolutionize how we own, trade, and finance everything from real estate to art, from corporate bonds to carbon credits. McKinsey Company projects tokenized assets could reach $5 trillion by 2030. BlackRock's Larry Fink calls it "the next generation for markets."

The vision is seductive: fractional ownership of a Manhattan skyscraper, 24/7 trading of Treasury bonds, instant settlement of complex derivatives, and democratized access to previously exclusive investments. By breaking down assets into digital tokens, proponents argue we can unlock trillions in "trapped" value, eliminate intermediaries, and create genuinely global, frictionless markets. That is the seductive lure for those that will benefit most from the transformation

As history has taught us, when a new financial product hits the market many rush into investing with the product thinking it’s a quicker way to build wealth but the only ones that tend to get wealthy are the people selling the product or concept. Remember the 2008 financial crisis? It was a result of several factors, one being the over leverage of derivatives. There seems to be a lot of excitement as we rush toward this digital promised land, because a good handful of people will benefit from it. But keep in mind that it comes with risk, we're building new systemic risks that could make previous financial crises look quaint by comparison. The question isn't whether tokenization will transform finance—it will. The question is whether we're prepared for what happens when something goes catastrophically wrong in a world where everything is tokenized, interconnected, and moving at the speed of code. Add leverage to the equation and you can guess what will happen. So, we decided to take a look at the potential downside because we know from history that the salespeople will only tell you the benefits, not the consequences and downside.

The Architecture of a New Financial System will span multiple categories, each with distinct risk profiles:

Security Tokens: Digital representations of traditional securities—stocks, bonds, derivatives. Companies like tZERO

https://tzero.com/ and Polymath have already tokenized billions in traditional assets, promising lower costs and faster settlement.

Asset-Backed Tokens: Real-world assets from real estate to commodities. Platforms like RealT sell tokens representing fractional ownership of rental properties, while Paxos has tokenized gold reserves.

Synthetic Tokens: Derivatives that track asset prices without actual ownership. Synthetix allows users to trade synthetic versions of stocks, commodities, and currencies, creating exposure without underlying assets.

Infrastructure Tokens: The Hidden Machinery of Digital Finance

Think of infrastructure tokens as the pipes and pumps that keep digital finance flowing. Just like your home needs plumbing to move water, decentralized finance (DeFi) needs these special tokens to move money around.

Here are the main types:

Governance tokens - These are like voting shares. If you own them, you get to vote on how a platform operates, similar to how shareholders vote in company decisions.

Liquidity pool tokens - When you deposit money into a shared pool that others can trade against, you receive these tokens as a receipt. They prove you own part of that pool and earn you a share of the trading fees.

Yield-bearing tokens - These automatically grow in value over time, like a savings account that adds interest directly to your balance. They represent money you've lent out that's earning interest.

These tokens power the robots of finance—automated programs that match buyers with sellers (called automated market makers) and systems that let people borrow and lend without banks.

The Problem of Different Networks

Imagine if every country had completely different electrical outlets, voltages, and plug types. That's what blockchain is like today. Each network—Ethereum, Solana, Polygon, Avalanche—is like a different country with its own rules:

• Different security systems (how they protect against hackers)

• Different validation methods (how they confirm transactions are real)

• Different weak points (what could go wrong with each one)

To move tokens between these networks, we need "bridges" special connection points that let you send tokens from one blockchain to another. But here's the catch: every bridge is like a border crossing that hackers can attack. The more bridges we build, the more potential weak points we create.

It's like having multiple doors in your house—convenient for moving around, but each door is another place a burglar could break in.

The Cascade Scenario: How Tokenization Could Trigger a Crisis

Imagine it's 2027. Tokenization has succeeded beyond expectations. Major institutions have custody tokenized assets. Pension funds hold tokenized real estate. Corporate treasuries park cash in tokenized money market funds. The plumbing works great —until it doesn't. Here is a scenario

Act I: The Trigger

A major stablecoin—let's call it Trust-USD, backed by tokenized Treasury bonds and commercial paper—experiences a "depeg" event. (Meaning that the stablecoin loses its intended 1:1 value relationship with its reference currency)

Perhaps hackers exploit a smart contract vulnerability, or redemptions surge during market stress, or the underlying collateral proves less liquid than assumed. Within minutes or a few hours, Trust-USD trades at 85 cents, triggering automatic liquidations across DeFi (Decentralized Finance) protocols.

This means:

Loss of Confidence: People no longer trust that 1 Trust-USD = $1.00

Redemption Runs: Everyone tries to redeem their stable coins at once

Liquidity Crisis: The issuer can't sell the underlying assets fast enough to meet redemptions

Market Pricing: The stablecoin trades below $1 on exchanges as sellers outnumber buyers

Why Depegs Trigger Cascading Failures

In DeFi (Decentralized Finance), stablecoins are used as collateral across numerous protocols. When a stable-coin depegs several things happen:

Automatic Liquidations: Smart contracts that assumed $1 = 1 stable-coin suddenly calculate the collateral as worth less, triggering forced selling

Contagion: Other stable-coins face redemption issues as users panic

Protocol Insolvency: Lending protocols that accepted the stable-coin as collateral face bad debts

Feedback Loop: Forced selling drives the price down further, triggering more liquidations.

In my scenario, the depeg of one major stablecoin starts a domino effect that spreads throughout the entire tokenized asset ecosystem, similar to how the Reserve Primary Fund "breaking the buck" in 2008 triggered a money market fund crisis.

Act II: The Contagion

The liquidations create a death spiral. Protocols automatically sell tokenized assets to maintain collateral ratios, driving down prices. Other stable coins wobble as confidence erodes. Tokenized real estate funds face redemption requests they can't meet—how do you instantly sell 1/10,000th of an office building?

Cross-chain bridges, holding billions in locked assets, become targets. If hackers compromise a major bridge—as happened with Wormhole ($320 million) and Nomad ($190 million)—assets on multiple chains become orphaned or worthless.

Traditional finance, now deeply integrated with tokenized markets, can't escape. Banks holding tokenized assets as collateral face margin calls. Money market funds with tokenized commercial paper positions break the buck. Corporate treasurers discover their "safe" tokenized government bond holdings are trapped in frozen smart contracts.

Act III: The Breakdown

As panic spreads, fundamental questions emerge: Who actually owns what? If a tokenized real estate platform fails, do token holders have claims on actual buildings or just unsecured creditor status? When a cross-chain synthetic asset depegs from its underlying, who bears the loss?

Regulators, still operating with frameworks designed for traditional assets, struggle to respond. The SEC, CFTC, Treasury, and state regulators all claim jurisdiction—or disclaim responsibility. International coordination proves impossible as different countries have incompatible approaches to digital assets.

The Federal Reserve faces an unprecedented dilemma: How do you backstop a decentralized system? Traditional tools—discount window lending, quantitative easing, bank bailouts—don't map onto pseudonymous wallets and autonomous protocols. Meanwhile, automated smart contracts continue executing, liquidating positions and transferring assets according to code, regardless of real-world chaos.

The Unique Vulnerabilities of Tokenized Systems

Smart Contract Risk: The Immutable Flaw

Smart contracts are "immutable" once deployed; they can't be changed. This feature, touted as eliminating counterparty risk, becomes a critical vulnerability. A bug in a major tokenization platform could lock billions in assets permanently. The 2016 DAO hack, which forced Ethereum to hard fork, would pale compared to frozen tokenized Treasury bonds or mortgages.

Complex smart contracts interact in unexpected ways. "Composability"—the ability to combine protocols like Lego blocks—means a failure in one can cascade through others. Flash loan attacks, where attackers borrow, manipulate, and repay millions in a single transaction, demonstrate how quickly automated systems can be gamed.

Oracle Dependency: The Real-World Connection

Tokenized real-world assets require "oracles"—data feeds connecting blockchains to external information. If tokenized Tesla stock needs Tesla's NYSE price, who provides it? How do you prevent manipulation? The oracle problem remains unsolved, creating a critical weakness where digital meets physical.

Imagine tokenized commercial real estate during a market crisis. Property valuations, typically updated quarterly through appraisals, can't support instant, 24/7 token trading. During stressed conditions, oracle failures or manipulations could cause massive mispricing’s, triggering unnecessary liquidations or enabling profitable exploits.

Regulatory Arbitrage: The Race to the Bottom

Tokenization enables instant global asset transfers, but regulations remain stubbornly national. A tokenized security might be created under Singapore law, traded on a Cayman Islands exchange, held by a Swiss institution, and represent ownership of U.S. real estate. When disputes arise, which laws apply? Which courts have jurisdiction?

This complexity invites regulatory arbitrage. Actors shop for favorable jurisdictions, creating weaker links in the global financial system. The 2008 crisis showed how regulatory gaps in one country—U.S. subprime mortgages—could trigger global collapse. Tokenization multiplies these gaps exponentially.

Operational Chaos: When Code Meets Law

Traditional finance has centuries of legal precedent handling failures—bankruptcy procedures, clearinghouse protocols, and resolution mechanisms. Tokenized assets exist in a legal gray zone. Consider cascading complexities:

A tokenized REIT fails. Do token holders have equity claims, debt claims, or just contractual rights?

A major exchange holding customer tokens declares bankruptcy. Are tokens customer property or exchange assets?

A government sanctions a blockchain address holding tokenized assets. How do compliant institutions handle contaminated tokens?

A court orders reversal of tokenized asset transfers. How do you reverse immutable blockchain transactions?

The Systemic Risks: Beyond Individual Failures

Hyper liquidity Becomes Hyper volatility

Tokenization's promise of 24/7 liquidity could become a curse during crises. Traditional markets have circuit breakers, trading halts, and human judgment. Tokenized markets operate continuously, allowing panic to build without pause. A weekend crisis in tokenized markets could present traditional finance with devastating losses Monday morning.

The speed of automated trading in tokenized markets—measured in milliseconds—means crises unfold faster than human intervention. By the time regulators convene emergency meetings, billions in value could evaporate, and contagion could spread globally.

Concentration Behind Decentralization's Veil

Despite blockchain's decentralized ethos, tokenization markets show concerning concentration:

• A handful of stable coins dominate liquidity

• Major exchanges custody most tokenized assets

• Few oracle providers supply critical price feeds

• Specific smart contract platforms handle most value

This concentration means that single points of failure could crash entire ecosystems. When AWS experiences outages, multiple blockchain services fail simultaneously. If a major stable coin issuer faces regulatory action, tokenized markets could freeze globally.

The Interoperability Trap

Cross-chain bridges and wrapped tokens create interconnection without true interoperability. Each bridge represents a honeypot for hackers and a potential breaking point during stress. As more assets become tokenized across different chains, these bridges become systemically important financial infrastructure—yet they operate without oversight, standards, or backstops.

The Regulatory Vacuum: Fighting Tomorrow's Crisis with Yesterday's Tools

Current regulatory frameworks weren't designed for tokenized assets' unique characteristics:

Securities Laws: Written for paper certificates and centralized exchanges, struggle with peer-to-peer token trading and automated market makers.

Banking Regulations: Assume institutions hold customer assets, not self-custody wallets and smart contracts.

Tax Codes: Can't handle thousands of micro-transactions, yield farming, or liquidity provision rewards.

Anti-Money Laundering: Requires identity verification incompatible with pseudonymous blockchain transactions.

Regulators face an impossible choice: Apply existing rules that don't fit, potentially killing innovation, or create new frameworks while technology evolves faster than legislation. Meanwhile, enforcement actions remain selective and unpredictable, creating uncertainty that itself becomes a systemic risk.

The Social Consequences: When Financial Democracy Fails

Tokenization promises financial inclusion—anyone with a smartphone can own fractional shares of previously inaccessible assets. But this democracy could become devastating during a crisis:

Retail Investors: Without institutional safeguards, lose life savings in complex products they don't understand.

Pension Funds: Seeking yield, allocate to tokenized assets that prove illiquid during stress.

Developing Nations: Adopt tokenized systems to leapfrog traditional finance, only to discover they've imported first-world financial crises.

Criminal Networks: Exploit regulatory gaps and pseudonymous transactions, undermining system integrity.

The 2008 crisis showed how financial innovation—mortgage-backed securities—could destroy household wealth. Tokenization could democratize such destruction, spreading losses wider and faster than ever before.

Preventing Catastrophe: Building Resilient Tokenized Markets

Despite these risks, tokenization's benefits—efficiency, accessibility, transparency—remain compelling. Rather than avoiding tokenization, we must build resilience:

Technical Safeguards

Formal Verification: Mathematical proofs of smart contract correctness before deployment Upgrade Mechanisms: Carefully designed procedures for fixing critical bugs without compromising decentralization Standard Audits: Mandatory security reviews for systemically important tokenization platforms Circuit Breakers: Automated pause mechanisms during extreme volatility or suspicious activity

Regulatory Evolution

Regulatory Sandboxes: Safe spaces for tokenization experiments with relaxed rules but close monitoring International Coordination: Global standards for tokenized asset issuance, trading, and settlement Clear Taxonomies: Definitive classification of token types and applicable regulations Resolution Frameworks: Predetermined procedures for handling tokenized asset platform failures

Market Structure Improvements

Decentralized Identity: Privacy-preserving compliance enabling regulation without destroying pseudonymity Insurance Protocols: Decentralized coverage for smart contract failures and operational risks Transparency Standards: Real-time, on-chain reporting of tokenized asset backing and platform health Stress Testing: Regular simulations of crisis scenarios across interconnected tokenized markets

Conclusion: The Stakes of Getting It Wrong

Tokenization represents finance's next evolutionary leap, potentially unlocking trillions in value and democratizing access to wealth-building assets. But evolution includes extinction events. As we tokenize the world's assets, we're not just digitizing ownership, we're already rebuilding the financial system's foundation while the building remains occupied.

The risks aren't theoretical. Every smart contract hack, stablecoin failure, and bridge exploit provides a preview of potential systemic crises. Yet we continue building at breakneck pace, adding complexity faster than we develop safeguards.

History has shown financial innovation follows a predictable pattern: enthusiasm, excess, crisis, and regulation. With tokenization, we have a rare opportunity to break this cycle—to build safeguards before, not after, catastrophe. But this requires acknowledging uncomfortable truths: code isn't law, decentralization doesn't eliminate risk, and transparency doesn't prevent panic.

The question isn't whether tokenization will transform finance; that transformation is already underway. The question is whether we'll master this technology or whether, like previous financial innovations, it will master us. The answer depends on the choices we make today, while the system remains small enough to fix but large enough to matter.

As assets worth trillions flow onto blockchains, we're conducting an experiment with the global financial system. We'd better get it right—because in a tokenized world, when things go wrong, they could go wrong for everyone, everywhere, all at once. And unlike traditional finance, there might be no central authority capable of pressing "pause" when the crisis comes.

The Week Ahead

Volatility in technology stocks is likely to continue as investors gear up for Nvidia’s next earnings report on Wednesday after market close. Expectations are high going into the news, given that the world’s largest company by market value has a history of exceeding analyst forecasts and raising future guidance. There are also earnings reports due from U.S. retail giants Home Depot, Target, and Walmart—the last of which just announced the retirement of its CEO. On the economic calendar, there is still much uncertainty around when and if U.S. data releases will resume information that is critical to the Fed’s rate decision next month. Late last week, the Bureau of Labor Statistics announced that the September jobs report will be released this Thursday. Minutes from the prior FOMC meeting will arrive on Wednesday, but recent comments from committee members have taken precedence on how the central bank’s views are evolving. There are important non-government data points this week for investors to consider, including flash PMI results for early November, regional manufacturing surveys, existing home sales, and revised consumer sentiment figures. On the international side, the flash PMI surveys from Europe and Australia will also garner attention at week’s end. Japan releases its preliminary Q3 GDP number as well as an inflation update. The sinking value of the Japanese yen may pressure the Bank of

Japan to raise rates sooner rather than later, so Thursday evening’s CPI report takes on added significance. Wednesday’s UK CPI release is expected to reveal a cooling to 3.6% YoY from 3.8%, a result that would further support a rate cut in December