Big week of Information for the Markets

This article is provided by Gene Witt of Optimized Capital LLC. for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments or to be considered investment advice. Investing involves the risk of loss, and investors should be prepared to bear potential losses. Investments should only be made after a thorough review with your investment advisor, considering all factors, including personal goals, need,s and risk tolerance. Optimized Capital Registered Investment Adviser (RIA) that maintains a principal place of business in the State of Illinois and Indiana. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements.

Newsletter

Week ending Oct 24, 2025

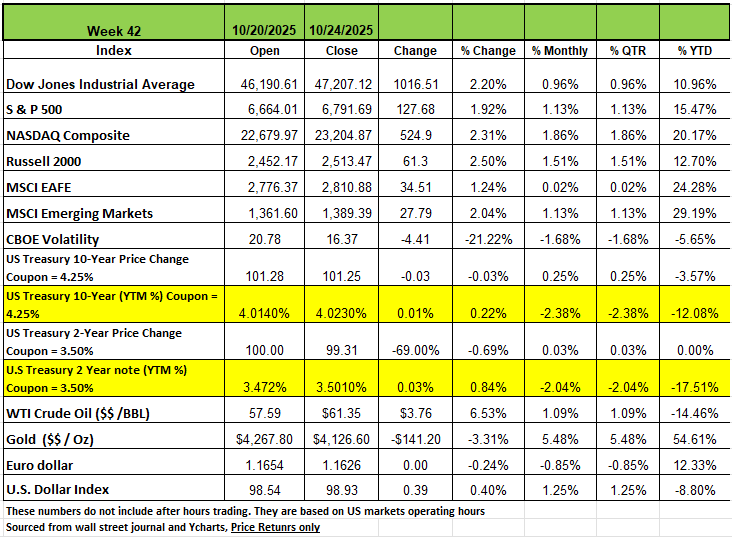

All four of the major indices rose last week with the Russell 2000 leading the pack with a 2.5% bump, followed by the NASDAQ up 2.31% The DOW ended the week at 47,207.12 up 2.2% and the S&P 500 index rose 1.9% last week to a new closing high of 6,791.69. The S&P 500 ended Friday's session at 6,791.69. The market benchmark also reached a fresh intraday high on Friday at 6,807.11.

This week's gain brought the S&P 500 into positive territory for the month. It's now up 1.5% for October and 15% for the year.

Data released on Friday showed US consumer prices rose less than expected in September. The report, which had been delayed by the ongoing government shutdown, showed the consumer price index rose 0.3% month on month in September, slower than August's 0.4% climb and lower than the Bloomberg-polled consensus estimates for a 0.4% increase. Annually, inflation accelerated to 3% from August’s 2.9% but was below Wall Street's 3.1% estimate.

Core inflation, which excludes the volatile food and energy components, slowed to 0.2% from 0.3% in August. The annual core measure eased to 3% from 3.1%. The market expected both measures to remain unchanged.

Trump decided to put new sanctions on Rosneft and Lukoil to increase pressure on Putin and Russia as the war in Ukraine continues.

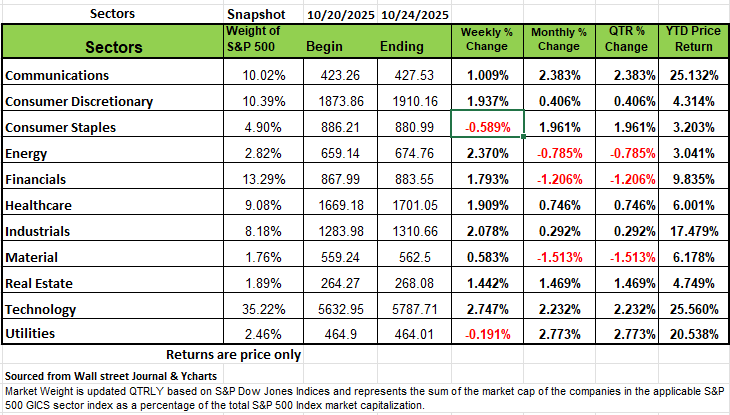

More defensive sectors, such as consumer staples and utilities, lagged the broader market as the AI trade continued. The preliminary October figures for the S&P Global US Manufacturing PMI and the S&P Global US Services PMI were expansionary, at 52.2 and 55.2, respectively, versus the expected 52.0 and 53.5.

The final October figure for the University of Michigan consumer sentiment survey was 53.6, down from the 55.0 reading in the previous month. Various leading indicators have been delayed by the government shutdown, as were the initial jobless claims for the week ending October 18th.

This week, we expect durable goods orders, the Richmond Fed Manufacturing Index, the Conference Board’s consumer confidence survey, inventories, a FOMC rate decision, another week of initial jobless claims, GDP data, personal income, and personal spending. On the earnings front, 172 members of the S&P 500 announced this week, including influential mega-caps Apple, Microsoft, Alphabet, Amazon.com, and Meta Platforms.

Sectors

The technology sector led the week's gains, climbing nearly 2.8%, followed by a 2.4% rise in energy and a 2.1% increase in industrials. Consumer discretionary and health care rose 1.9% each. Financials, real estate, and communication services also added at least 1% each, while materials edged up 0.6%. International Business Machines ( IBM ) was among the top gainers in technology, climbing 9.3% as the company lifted its full-year revenue growth outlook and reported better-than-expected third-quarter results. Revenue is now anticipated to rise by more than 5% in constant currency terms for 2025, the computer and software company said, compared with its previous projections for growth of at least 5%.

Intel's (INTC) shares also gave the tech sector a lift, rising 3.4%. The company reported it turned a profit in the third quarter as revenue unexpectedly rose, thanks to artificial intelligence boosting demand for computing power.

The energy sector's advance came as crude oil futures also rose on the week. Halliburton (HAL) was the sector's top gainer, jumping 19% as the company reported higher-than-expected Q3 adjusted earnings per share and revenue. Analysts at HSBC and RBC upgraded their investment ratings on the stock after the report.

Not all sectors rose this week. Consumer staples shed 0.6% and utilities edged down 0.2%.

Molson Coors Beverage (TAP.A ) was among the top decliners in consumer staples, falling 4%. The beverage and brewing company unveiled plans to cut 400 salaried positions across its Americas business by the end of this year as part of a restructuring plan aimed at streamlining operations. Economic data may be light if the US government shutdown continues. The shutdown has caused a delay in closely watched government data releases, including the September jobs report.

The Federal Reserve's Monetary Decision

&

Possible Stock Market Outcomes Following

This is a particularly interesting week in the markets. The stock market’s record-setting drive faces a midweek double whammy as a pivotal Federal Reserve’s interest-rate decision collides with a flood of mega-cap tech earnings — all unfolding against the backdrop of a prolonged government shutdown. How the markets will react is anyone’s guess. About one third of the companies in S&P 500 will be releasing their earnings for Q3, many analysts believe that most companies will report better than expected earnings. But forward guidance will be just as important. Additionally, the Federal Reserve is holding its Open Market Committee (FOMC) meeting this Tuesday and Wednesday. This week in particular the stock market will face a pivotal moment, depending on the outcome of this meeting, and the decision to hold or cut the federal funds rate. This will most likely be a critical driver of market sentiment and the markets response. While analysts often form a strong consensus, the market's reaction can be swift and varied across all sectors, heavily influenced by whether the decision meets, exceeds, or falls short of expectations, as well as the accompanying commentary from the Fed Chair Powell. So here are what we think are three potential outcomes.

Scenario 1: Interest Rate Cut (Widely Expected Outcome)

A decision to cut the federal funds rate is generally interpreted as a dovish move, intended to stimulate economic activity by lowering borrowing costs for businesses and consumers.

Potential Market Reaction:

Initial Positive Reaction: A rate cut that is already widely expected may lead to a modest, "priced-in" rally. If the cut is larger than anticipated 25 basis points, the stock market could see a more significant, immediate surge as it signals the Fed is more aggressive in supporting the economy.

Sector Performance:

Growth Stocks (e.g., Technology): Often see the biggest boost. Lower rates increase the present value of future earnings, which disproportionately benefits companies with high growth expectations far into the future.

Cyclical Sectors (e.g., Consumer Discretionary, Industrials):

May rally as cheaper financing and increased consumer spending are anticipated.

Financials:

May face pressure, as a smaller margin between what they pay on deposits and earn on loans can potentially reduce profit margins, though this is dependent on the overall shape of the yield curve.

Risk On:

Lower interest rates make riskier assets like stocks more attractive compared to fixed-income securities (bonds, CDs), which may see lower yields. This capital shift often propels equity prices higher. Keep in mind that we still see about $7.4 trillion sitting in Money market accounts, lower interest rates on this money could mean a shift into equities and bump equity prices higher.

Key Concern: The "Why"

If the Fed cuts rates due to an unexpectedly steep deterioration in the labor market or looming recession fears, the initial positive market reaction might be short-lived. Investors could interpret the cut as a sign of underlying economic weakness, leading to turbulence and a retreat from risky assets. The accompanying guidance from Fed Chair Jerome Powell will be crucial for context. One more note is that when unemployment rises, we tend to see a selloff from employees cashing in their 401K plans. Approximately 45% of employees will either borrow or completely cash out their 401K plan when they leave an employer. This would be an additional sell-off.

Scenario 2: Holding Rates Steady (Less Likely, but Possible)

If the Fed decides to hold the federal funds rate steady, it will signal that policymakers believe that the current economic conditions—such as a resilient job market or persistent, above-target inflation—do not warrant immediate easing.

Potential Market Reaction:

Negative Reaction: A decision to hold rates steady, especially when the market has priced in a cut already, is considered a hawkish surprise. This may likely lead to a sell-off in stocks, particularly growth-oriented and interest-rate-sensitive sectors, as expectations for cheaper capital are dashed.

Higher Borrowing Costs: Stable rates maintain higher borrowing costs, which can dampen business investment, corporate profits, and consumer spending, thus pressuring stock valuations.

Bond Market: Treasury yields would likely jump as bond prices fall, reflecting the market's repricing of future rate expectations.

Uncertainty and Volatility: This outcome would introduce significant uncertainty regarding the timing of the next rate move, potentially increasing market volatility.

Scenario 3: Unexpected "Hawkish Cut" or "Dovish Hold"

The guidance and rhetoric surrounding the decision often matter more than the decision itself.

The "Hawkish Cut": The Fed cuts rates as expected but issues a cautious or hawkish statement suggesting the easing cycle may be short-lived or that future cuts are highly dependent on improving inflation data. The market reaction would be mixed: an initial positive bump followed by skepticism and potential choppiness as traders digest the uncertainty of future policy.

The "Dovish Hold": The Fed holds rates steady but issues a dovish statement strongly indicating that a rate cut is imminent in the next few months, perhaps citing the need for more comprehensive economic data. In this case, the negative reaction from the Hold would be partially mitigated by the positive forward guidance, keeping a floor under the market.

The Influence of Quantitative Tightening (QT)

In addition to the interest rate, investors will be watching for any signals about the end of Quantitative Tightening (QT), the process of shrinking the Fed's balance sheet. An earlier-than-expected announcement to end QT would increase liquidity in the financial system, acting as a supportive, dovish signal for the stock market, regardless of the interest rate decision.

The Big Picture:

Ultimately, the stock market's reaction on Wednesday will hinge on the degree of surprise relative to market expectations and the Fed's outlook on the economy. A clear signal that the Fed is providing insurance against a slowdown without acknowledging a full-blown recession is generally the most favorable outcome for a continued bull market

The Week Ahead

Regardless of whether the government shutdown ends this week or not, the Federal Reserve will be forced to make its decision on interest rates with an incomplete picture of the U.S. economy. It may be difficult for market observers to square a resilient economy—evidenced by solid Q3 GDP estimates and stocks at all-time highs—with a softening labor market. However, the contrast is unlikely to prevent the Fed from cutting rates on Wednesday. Several important economic reports that were due to be released after the Fed decision will likely not be—including that first estimate of Q3 GDP and September’s core PCE price index. The continued lack of new data will put even more emphasis on this week’s earnings announcements, with nearly 45% of the Nasdaq-100’s and 25% of the S&P500’s respective market values due to report—including Meta, Microsoft, and Alphabet on Wednesday, followed by Apple and Amazon on Thursday. Investors will be digging into what these companies say about artificial intelligence, given the technology’s outsized influence on equity valuations. On the international calendar, central banks will be in focus. The Bank of Canada is expected to cut rates by 25 basis points, while the European Central Bank and Bank of Japan are predicted to hold rates steady. Inflation updates from Australia and the Eurozone are also on the docket. Finally, President Trump’s visit to Asia—culminating in a scheduled meeting with Chinese President Xi on Thursday in South Korea—is a potential source of market volatility as the two countries aim to manage disagreements and improve relations.