Weekly Economic and Market update week of Oct 20 2025

Week ending Oct 17, 2025

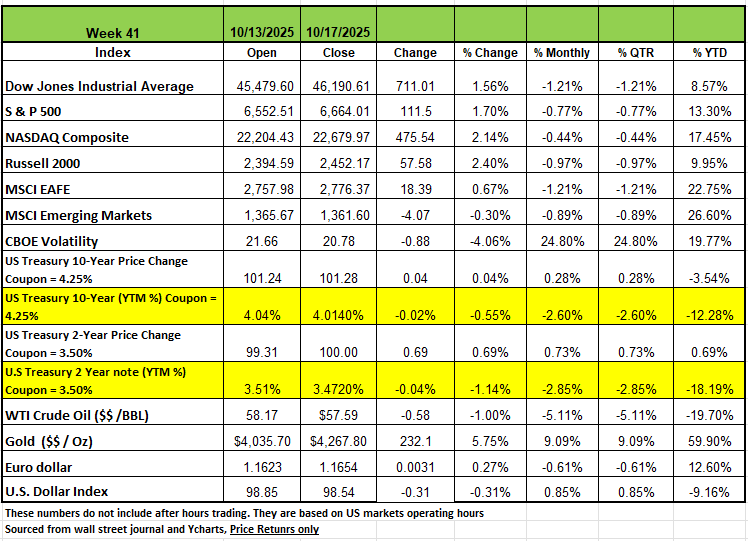

All of the major indices were in the black last week, coming off of the previous week’s declines based on the President's promise to hit some countries with higher tariffs. Last week’s leader was the Russell 2000 (RUT) +2.4% followed by the NASDAQ +2.14% The S&P 500 index rose +1.7% and the DOW was up +1.56% as earnings season kicked off on a largely positive note and the President said his proposed 100% additional tariffs on China are "not sustainable."

Trepidation in the credit markets was present all last week after comments from big bank CEOs, most notably JPMorgan’s Jamie Dimon, rattled confidence that more credit events like auto parts distributor First Brands and subprime auto lender Tricolor could be the first “cockroaches” to appear and that more could be lurking on banks’ balance sheets. A few days later, regional banks Zions Bancorp and Western Alliance Bancorp suffered double-digit declines as the two banks said they were victims of fraud on loans to funds that invest in distressed commercial mortgages. Leaders of other regional banks calmed fears of a similar credit events as more regional banks released quarterly results on Friday. The third quarter reports showed fewer provisions for loan losses than analysts had forecast, bolstering the confidence in the group. Looking ahead to next week, data on jobs, home sales, CPI, and consumer sentiment are all set for release.

Treasury yields were down across the board for the third consecutive week, with the 10-year, falling to its lowest level in 2025. The lack of economic data during the near 3-week government shutdown has created uncertainty within markets. The combination of a fresh wave of U.S.-China tensions (beginning last week) and fresh concerns about regional banks, bad loans, and credit stress in the banking sector triggered a global selloff and amplified the demand for safe-haven assets. Meanwhile, on Tuesday, Fed Chair Jerome Powell signaled that the central bank remains on course for further rate cuts, reinforcing the view that the economy is in need of a boost. MBA mortgage applications fell -1.8% for the week ending October 10th, marking the third consecutive weekly decline. The Empire State Manufacturing Index for general business conditions unexpectedly jumped to 10.7 in October, up from -8.7 in September. The outlook also strengthened, reaching its highest level since the beginning of the year, even as price pressures persisted. Following sharp declines last month, both new orders and shipments rebounded, with the new orders index rising to 3.7 and the shipments index increasing to 14.4.

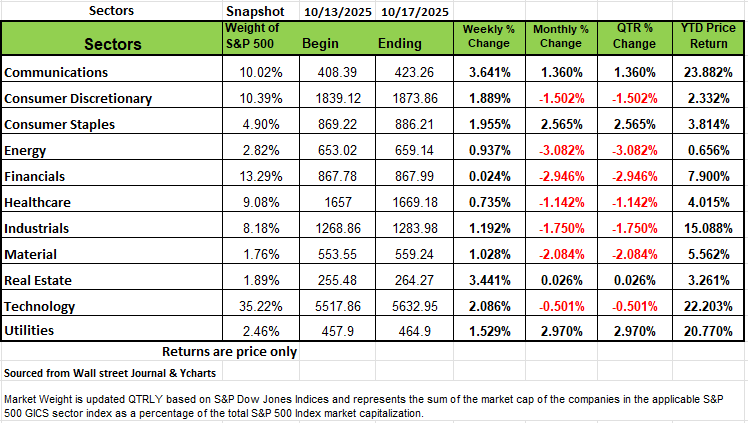

Sectors

All of the S&P 500's sectors rose last week. Communication services had the largest percentage increase, up +3.6%, followed by a +3.4% climb in real estate, a +2.1% rise in technology and a +2% advance in consumer discretionary. The slimmest gain was recorded in financials, which edged up just 0.02%.

Warner Bros. Discovery ( WBD ) was among the best performers in communication services, rising +6.4% amid a New York Post report that Paramount Skydance (PSKY) CEO David Ellison could submit an official merger bid for Warner Bros. Discovery ( WBD ) in the coming days. Ellison is engaging with Apollo Global Management (APO) to finance any bid, according to the report.

Prologis ( PLD ) shares had the largest weekly percentage increase in the real estate sector, jumping +12% as the company reported Q3 core funds from operations and revenue above analyst estimates and raised its 2025 guidance.

Micron Technology ( MU ) was among the top performers in the technology sector. Shares rose 11% amid reports the company's planned $100 billion semiconductor megafab in Onondaga County will be linked to a power substation following approval by New York state regulators of a new underground transmission line.

In the financial sector, gainers were nearly canceled out by decliners. The upside was led by shares of American Express ( AXP ) , which rose 9.6% as the payments company lifted the bottom end of its full-year outlook after third-quarter results surpassed market estimates amid card member spending growth.

Decliners in the financial sector included shares of Progressive (PGR), whose third-quarter profit missed Wall Street's expectations as its combined ratio deteriorated. The insurance company's stock fell 6% on the week.

Many large companies are expected to release quarterly results next week, including Tesla (TSLA), Netflix (NFLX), GE Aerospace (GE), Coca-Cola (KO), Philip Morris International (PM), International Business Machines (IBM), T-Mobile US (TMUS), Intel (INTC), Union Pacific (UNP) and Procter & Gamble (PG).

Economic data may be light if the US government shutdown continues. The shutdown has caused a delay in closely watched government data releases, including the September jobs report.

Gold has been used as a currency and medium of exchange for thousands of years, making it one of the oldest forms of money in human history. It is a timeless safe-haven asset, even though its value can be volatile at times. Recently, gold has been on a remarkable tear. So far this year, the precious metal has shattered record after record, surging nearly 65% since the start of the year and trading at $4,383.60 per ounce as of October 20, 2025. This explosive rally isn't just capturing the attention of gold investors and collectors; it's sending important signals to the equity markets about the broader economic landscape. But what's driving gold's ascent, and more importantly, what does it mean for stocks?

Let's explore.

The numbers tell a compelling story. Gold entered 2025, trading around $2,658 per ounce. By Q1, the average price had reached $2,860, and it's now trading at $4,383.60 as of mid-October, with analysts forecasting continued strength throughout the remainder of the year. This represents one of the most significant rallies in recent memory.

What's particularly notable is that this surge reflects more than just momentary market excitement. According to the World Gold Council, “the recent strength is supported by "deep structural demand across sectors and geographies," suggesting this rally has substantial underpinnings rather than speculative froth.

The Forces Behind Gold's Rise

Several interconnected factors are propelling gold prices higher, and understanding them is crucial for equity investors because these same drivers often reshape the equity markets. The elephant in the room is trade policy. The resurgence of trade tensions, particularly surrounding U.S. tariff discussions, has created significant market uncertainty. When investors face policy uncertainty, they tend to gravitate toward safe-haven assets, such as gold. This dynamic is self-reinforcing: as uncertainty persists, demand for gold increases, pushing prices higher and creating the perception that economic trouble may be brewing. This sentiment often precedes equity market volatility.

Persistent geopolitical risks globally have also intensified the appeal of gold as a hedge against economic uncertainty. Central banks worldwide have been accumulating gold at record rates, a trend that suggests institutional recognition of elevated global tensions. Central bank purchases are expected to average around 710 tons quarterly throughout 2025, compared to the pre-2022 average of 500-600 tons. This isn't casual buying; it’s strategic positioning by governments preparing for potential instability.

The U.S. dollar index has declined roughly 8% year-to-date in 2025. Since gold is priced in dollars, a weaker greenback makes the metal cheaper for international buyers holding other currencies, boosting foreign demand. More importantly, dollar weakness often signals market concerns about U.S. economic or fiscal health, which inevitably impacts equities. The two don't move in isolation; dollar depreciation typically comes with equity market pressures.

Central banks have paused or signaled the possibility of easing rates after one of the fastest tightening cycles in history. Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold, making it more attractive relative to bonds or cash. Additionally, with nearly $7 trillion parked in money market funds earning attractive rates, any decline in short-end rates should benefit zero-coupon assets like gold. However, these dynamics matter for stocks too; rate cuts can either signal economic weakness or provide relief and stimulus to equities.

Global sectoral debt has crossed a record $324 trillion in 2025, with nearly 30% on government balance sheets. This structural debt overhang creates demand for hedges like gold, as investors worry about long-term currency debasement or inflation concerns. This backdrop of excessive leverage also constrains equity valuations, as higher debt levels often signal slower future economic growth.

Gold's 2025 surge reflects legitimate macro concerns: trade uncertainty, geopolitical risks, debt levels, and currency questions. These same concerns will likely create choppy conditions for equity investors throughout the rest of 2025 and into 2026. Rather than seeing gold as a competitor to stock investments, investors should view it as insurance, a portfolio hedge that typically performs when equities struggle. In a diversified portfolio, gold and stocks don't need to move in perfect inverse lockstep. They just need to provide balance when one struggles, the other may perform better.

The Week Ahead

This week, investors hope for progress on ending the shutdown and more clarity on trade issues, while keeping an eye on geopolitical events and the credit markets. In the U.S., the delayed September CPI report is scheduled for Friday—observers expect headline inflation to have increased 0.4% MoM and 3.1% YoY—an increase from 2.9% YoY the prior month. The other important economic releases will be the flash PMI surveys for the manufacturing and services sectors along with revised consumer sentiment and inflation expectations. Several earnings announcements have market-moving potential, with reports due from Netflix, Tesla, IBM, Texas Instruments, and Intel, among others. On the international agenda, China may set the early tone for the week with the release of GDP, industrial production, and retail sales figures on Sunday evening. In Japan, all eyes will be on the political process for election of the new prime minister, set for Tuesday, while the latest inflation update arrives Thursday. Finally, in Europe the focus will be on the flash PMI readings, plus UK CPI and retail sales