Weekly Economic and Market update 10-10-2025

Week ending Oct 10, 2025

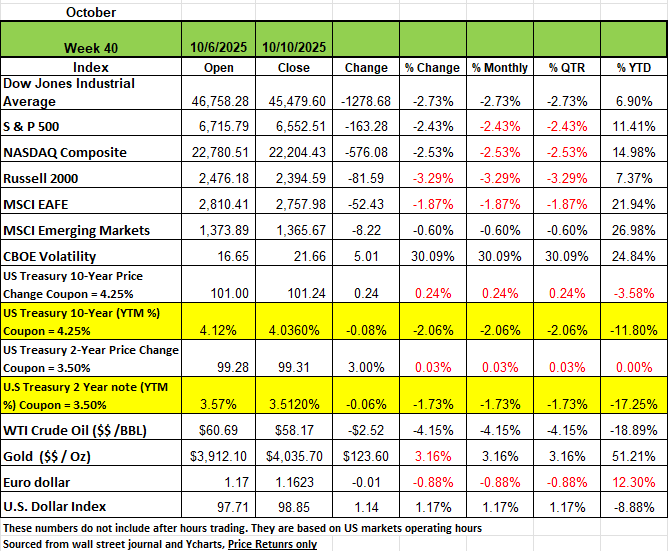

All 4 of the major indices declined last week, with the Russell 2000 declining the most with a -3.29% pullback, followed by the DOW -2.73%, the NASDAQ -2.53% and the S&P down 2.43%. However, it’s important to remember that all the indices are still up for the year. Much of the reversal came on concerns that Tariffs on Chinese imports would be increased significantly after China said it would control exports of rare earth minerals, which are needed for much of the growth in battery and semiconductor production.

Treasury yields were also down across the board for the second consecutive week. The threats between China and the U.S caused a selloff in stocks, oil, and cryptocurrencies while traders piled into safe-haven assets and pushed treasury yields to their lowest levels since mid-September, and gold prices continued to hit new highs, closing the week at $4035.7/oz. Friday’s University of Michigan Consumer Sentiment Index release also drove yields lower as the index fell from 55.1 in September’s final report to 55.0 for October’s preliminary report. The index sank to its lowest level since May, as a stalling job market and persistent inflation are weighing on consumers. Earlier in the week, MBA mortgage applications fell -4.7% after plummeting -12.7% in the prior week. This marks the largest two-week decline since April, as the recent uptick in mortgage rates continues to deter prospective buyers

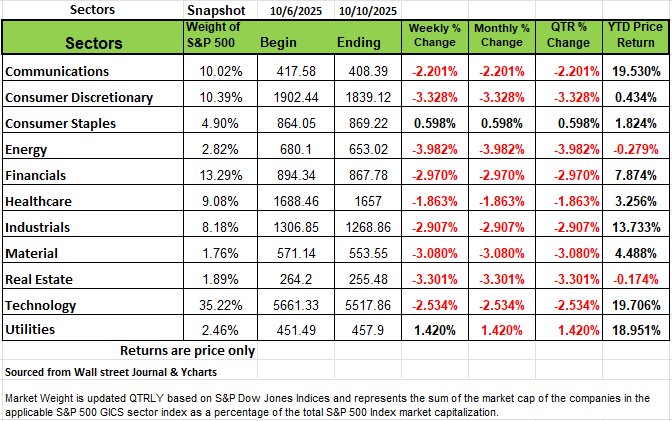

All but two sectors in the S&P 500 posted weekly declines. The energy sector had the largest weekly drop, falling -4%, followed by declines of -3.3% each in consumer discretionary and real estate. Materials lost -3.1% while financials and industrials shed almost -3% each. Technology and communication services fell more than 2% each, while health care was down -1.9%.

The energy sector's drop came as crude oil futures also fell on the week. Every component of the sector fell, led by an -11% loss in shares of APA Corp. (APA) and a -9.6% decline in shares of Halliburton (HAL).

Homebuilder D.R. Horton (DHI) had the hardest-hit stock in consumer discretionary, falling -13%. Evercore ISI downgraded its investment rating on the stock to in line from outperform and reduced its price target to $169 each from $185. In real estate, Alexandria Real Estate Equities (ARE) and CoStar Group (CSGP) led the declines, shedding -12% and -11%, respectively.

The two sectors that managed to stay in positive weekly territory were utilities, up +1.4%, and consumer staples, up +0.6%. NextEra Energy (NEE) was the best performer in utilities, rising +4.1%. The stock received price target increases from analysts at Seaport Global and HSBC this week.

The consumer staples sector, was boosted by a +5.7% jump in the shares of PepsiCo (PEP). The beverage company reported better-than-expected fiscal third-quarter results and issued an improved full-year earnings outlook amid easing foreign-exchange headwinds.

Earnings season is set to ramp up next week, especially in the financial sector. Reports are expected from companies including JPMorgan Chase (JPM), Johnson & Johnson (JNJN), Wells Fargo (WFC), Goldman Sachs (GS), BlackRock (BLK), Citigroup (C), Bank of America (BAC), Morgan Stanley (MS), Abbott Laboratories (ABT), Charles Schwab (SCHW) and American Express (AXP).

Economic data may be light if the US government shutdown continues. The shutdown has caused a delay in closely watched government data releases including the September jobs report.

This time is Not Different

Famed Investor Bob Farrell had over 50 years of market experience. He had witnessed many great opportunities and seen many down markets. Over his lifetime Bob developed some simple rules for investing. 10 to be exact. One of this most well-known rules is “This time is not different” referring to the euphoria that is often generated when everyone is making money.

Markets have a natural tendency to revert to their mean—their long-term average price—over time. When prices rise too far and too fast, they often exceed their rational value, creating an imbalance that ultimately corrects. Like a rubber band stretched beyond its limit, the market must eventually snap back before it can be stretched again. This dynamic is seen in stock prices that drift far from their moving averages but eventually return to more sustainable levels. Even in strong bull or bear markets, prices frequently revert to long-term trend lines or averages.

Rising prices often encourage speculative behavior, luring investors to chase profits beyond reason. In the midst of such euphoria, investors may act on emotion rather than fundamentals—driven by the fear of missing out (FOMO). The media amplifies this sentiment by constantly highlighting new market highs. For instance, the S&P 500 is up 11.47% year to date, but more strikingly, it has surged over 35% since April 7th, when markets responded to tariff policy developments.

However, much of this performance is concentrated in a small number of companies. Fourteen firms make up 42% of the S&P 500’s total weight, most of them technology driven. The only exceptions are Berkshire Hathaway, JPMorgan Chase, Visa, Eli Lilly, and Tesla. Sector allocations reveal that technology alone represents 35.2% of the index, followed by financials at 13.29%, consumer discretionary at 10.39%, communication services at 10.02%, healthcare at 9.08%, industrials at 8.18%, consumer staples at 4.9%, energy at 2.82%, utilities at 2.46%, and real estate at 1.89%.

Technology’s leadership has also boosted other sectors such as industrials and utilities, as energy demand rises to power ongoing advances in artificial intelligence. But it’s important to recognize that not everything in the market is performing at the same pace.

Professional traders often operate on short timelines—days or weeks—seeking quick profits from volatility. For individual investors, however, the focus must remain on understanding what they’re buying and at what price. Those distracted by full-time jobs or outside commitments face significant risks, especially in today’s speculative environment.

The Speculative Phase and Overvaluation

We are currently in a speculative phase marked by optimism about the future. Yet most traditional valuation models—price-to-earnings, price-to-sales, market-cap-to-GDP, and capitalized profits—show the market trading far above historical norms. If the economy continues to slow, as suggested by recent labor market data, these valuations appear even more stretched.

Eventually, the market will normalize—when or how is uncertain. In the meantime, wise investors should focus on intrinsic value and fundamentals. Every major speculative cycle—from the “Nifty Fifty” in the 1970s to the tech bubble of the late 1990s—has been accompanied by the belief that “this time it’s different.” But human psychology doesn’t change. Greed and fear remain constant forces. Ultimately, the laws of valuation and economic gravity prevail, often turning once-hyped “new era” stocks into ordinary companies with painful losses for those who bought near the top.

How Public Opinion Tracks Market Trends

Investor sentiment often mirrors market direction, making this one of the most dangerous behavioral traps. During bull markets, enthusiasm surges as seemingly everyone makes money—investing becomes a popular topic at dinner tables and dominates news headlines. Unfortunately, many amateur investors jump in near the top, chasing profits when valuations are highest.

Conversely, after major sell-offs, public interest fades and apathy sets in. Investors sell out of fear, often just before the market bottoms and begins to recover. Bob Farrell’s timeless observation holds: the greatest enthusiasm typically coincides with market peaks, and the deepest despair emerges near troughs. By the time an investment becomes widely viewed as a “sure thing,” most of the easy gains are already gone. Success in investing requires patience and contrarian thinking—the willingness to buy when others fear and to hold back when the crowd is most exuberant.

The Week Ahead

Volatility spiked sharply on Friday—the VIX index closed above 21—as skittish investors reacted to renewed tensions in U.S.-China trade negotiations. Mildly hawkish commentary from Fed officials

added to the uncertainty, as concerns mounted that the central bank may be headed for a policy mistake in continuing to lower rates. In the absence of official government data, several large

investment firms have attempted to fill the gap with employment growth estimates, but with widely divergent results. Data from Carlyle suggested job growth of just 17,000 last month, while a

report from Goldman Sachs indicated gains closer to 80,000. In either case, the decline of foreign-born workers risks masking the recent trend of lower payroll growth as only a demand-side issue

and could lead to higher wages and inflation if employers struggle to find available workers.

Turning to the week ahead, no additional votes on reopening the government are anticipated until at least Tuesday, which means expected economic reports may be further delayed. The U.S.

Labor Department announced that it will bring staff back to work on September’s CPI report, which is tentatively scheduled for Wednesday. Retail sales and housing data are not likely to be released without a funding bill. If the shutdown continues, questions could be raised about the Fed’s next rate decision given the lack of access to official economic data. If the shutdown ends, it could be challenging for government agencies to release all the missed data in a timely manner. Meanwhile, earnings season gets underway this week with most of the large U.S. banks reporting

along with global technology companies Taiwan Semiconductor and ASML Holdings. On the international calendar, China is scheduled to release trade and inflation figures this week, while

the UK has GDP and employment reports. Investors will continue to monitor the political turmoil in France and Japan that is contributing to rising volatility.

This article is provided by Gene Witt of Optimized Capital LLC. for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments or to be considered investment advice. Investing involves the risk of loss, and investors should be prepared to bear potential losses. Investments should only be made after a thorough review with your investment advisor, considering all factors, including personal goals, needs, and risk tolerance. Optimized Capital is a Registered Investment Adviser (RIA) that maintains a principal place of business in the State of Illinois and Indiana. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements.