A Tale of Two Forces, Navigating AI Hopes and Fed Rate Cut Bets

This article is provided by Gene Witt of Optimized Capital LLC. for general informational purposes only. It is an opinion, not investment advice. This information is not considered to be an offer to buy or sell any securities or investments, and again not to be considered investment advice. Investing involves the risk of loss, and investors should be prepared to bear potential losses. Investments should only be made after a thorough review with your investment advisor, considering all factors, including personal goals, needs, and risk tolerance. Optimized Capital Registered Investment Adviser (RIA) that maintains a principal place of business in the State of Illinois and Indiana. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements

Weekly Newsletter

Market Recap week ending

November 28th 2025

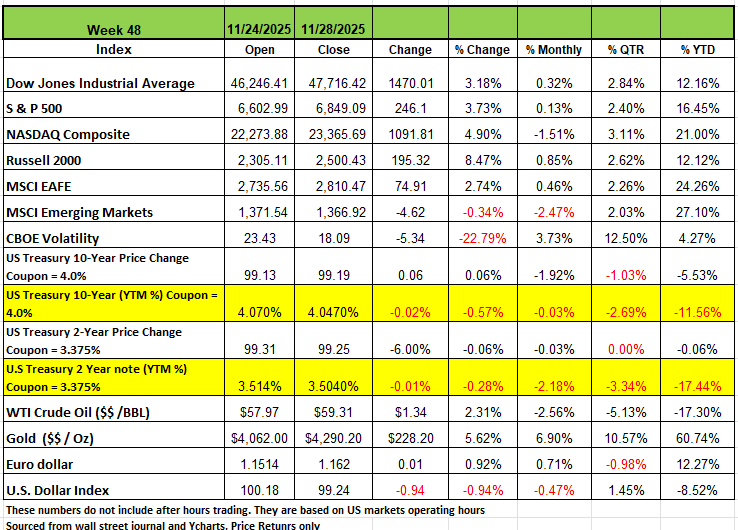

All of the major indices posted positive returns on an abbreviated week due to the Thanksgiving Holiday last week. The Russell 2000 had the highest returns with a +8.47% return followed by the NASDAQ +4.9%. The S&P 500 returned 3.7% and the DOW +3.18%. Last week's performance brought 3 of the 4 indices into the black for the month of November with only the NASDAQ posting a decline of -1.5% on the month. November is the 2nd most volatile month in 2025, only April was more volatile with Liberation Day and the President’s pivot on tariffs after markets declined dramatically on April 7th. Last week marked a significant turnaround in a short time -- just a week earlier, the S&P 500 had been down -3.5% for the month. The index is now up +16% this year.

Investors are growing increasingly more hopeful for the Federal Reserve's Federal Open Market Committee to cut its benchmark interest rates, especially after a report on private payrolls released this week by ADP showed a preliminary average decrease of 13,500 jobs in the four weeks ending on Nov. 8.

US September jobs numbers, which were just released last week due to delays related to the government shutdown, showed higher-than-expected non-farm payrolls. However, the unemployment rate worsened to 4.4% in September from 4.3% in August; a 4.3% rate had been expected. October jobs numbers from the government have yet to be released.

Treasury yields finished the holiday-shortened week slightly lower, as investors are now pricing in a roughly 83% chance of a quarter-point rate cut at the Federal Reserve’s upcoming December meeting. Last week, investors were pricing in a roughly 30% chance of a rate cut, but the September jobs report and comments from the New York Fed President John Williams have shifted sentiment. The September Producer Price Index (PPI) rose 0.3%, matching consensus expectations. “Core” prices, excluding food and energy categories, rose 0.1% in September and are up 2.6% versus a year ago. September retail sales rose 0.2%, lagging the consensus expected 0.4%. Sales have now risen for the fourth consecutive month as eight of the thirteen major categories saw increases. New orders for durable goods rose 0.5% in September, matching consensus expectations. Nearly every major category saw an increase in orders, led by a 30.9% increase in defense aircraft orders

By Sector

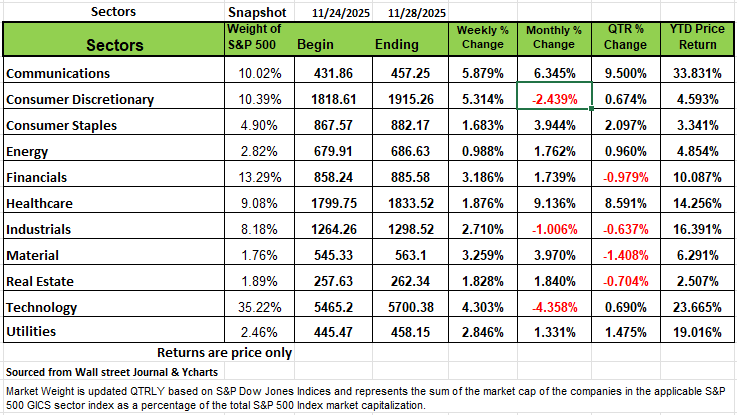

All of the S&P 500's sectors rose this week. Communication services had the strongest gain, up 5.9%, followed by a 5.3% climb in consumer discretionary and a 4.3% rise in technology. The smallest gain was logged by energy, which edged up 1%. Facebook parent Meta Platforms (META) had the largest percentage increase in communication services, jumping 9%. Google parent (GOOGL, GOOG) was also among the sector's top gainers, up slightly more than 6.8%. Meta is mulling using Google's tensor processing units in its data centers in 2027, and it may also rent those chips from Google's cloud unit in 2026, according to a report by The Information (https://www.theinformation.com/)

Tesla (TSLA) was the top performer in the consumer discretionary sector, climbing 10%. The electric vehicle manufacturer opened its first all-in-one center in Gurugram, India, offering sales, service, delivery, and charging facilities under one roof. Chief Executive Elon Musk also said the company plans to expand its fleet of robotaxis in Austin, Texas in December.

Earnings reports are expected next week from companies including CrowdStrike Holdings (CRWD) and Salesforce (CRM).

Economic data will include manufacturing data, automotive sales and private sector employment from ADP, all for November. The government is also expected to release September personal consumption expenditures, which had been delayed by the shutdown.

A Tale of Two Forces

Navigating AI Hopes and Fed Rate Cut Bets

Is the Tech-Led Rally Sustainable?

Last week saw a surge in U.S. markets, with the S&P 500 and NASDAQ posting their best weekly gains in months. Driving this optimism are two powerful, yet contradictory, forces: the unrelenting Artificial Intelligence (AI) boom and growing investor conviction that the Federal Reserve (Fed) will cut interest rates at its upcoming December meeting.

While the "AI trade" continues to fuel mega-cap tech stocks, delayed economic data released last week presented a mixed picture—one that both supports and challenges the market's enthusiasm for a Fed pivot. So, we thought we’d dive into what's driving the rally and the risks that lie beneath.

The Market Momentum: The AI Engine Keeps Running

The major indexes closed out the week firmly in the green, with the tech-heavy Nasdaq Composite leading the charge. This momentum was largely concentrated in a handful of technology giants:

The AI Narrative Dominates: AI-linked stocks, particularly those involved in chips and data center infrastructure, saw significant volatility but ended the week strong. News surrounding Alphabet (Google) and its newly released Gemini AI model, as well as its reported competition with Nvidia and Meta, kept the sector in focus.

The "December Dash": The strong late-month performance has been attributed to a combination of short-covering and a surge in investor confidence in the traditional "Santa Claus Rally" to close out the year.

Sector Winners & Losers: While large-cap tech outperformed, Small-Cap stocks also saw a strong rebound, benefiting from the expectation of lower future borrowing costs. Conversely, some of the more speculative AI-adjacent stocks (like certain server and cloud companies) experienced significant volatility as investors became more discerning about valuations.

The Fed Factor: Rate Cut Hopes Climb

Market sentiment swung decisively last week in favor of a December interest rate cut, with probabilities climbing sharply to over 80% (according to the CME FedWatch Tool). This move was spurred by new commentary from a Fed official suggesting that the central bank might be open to "further adjustment" in the near term.

Mixed Economic Signals

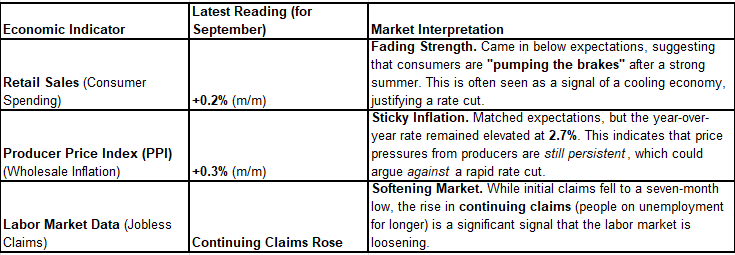

The Fed's decision, however, will be based on hard data—and last week's delayed economic reports were a mixed bag, adding complexity to the rate cut bet

Outlook: The Question of Sustainability

The market is currently pricing in a "Goldilocks" scenario: inflation is cooling enough to allow the Fed to cut rates, but not so fast that the economy is heading into a hard recession.

The Bull Case: Continued strong corporate spending on AI infrastructure drives high-margin growth for mega-cap tech, while a December rate cut provides a tailwind for the broader economy and boosts investor confidence into the new year.

The Bear Case: The concentration of the rally in a few AI stocks is unsustainable. If the economic slowdown evidenced by the retail sales data is sharper than anticipated, or if inflation proves too sticky (as hinted by PPI), the Fed may disappoint the market by delaying or offering a smaller rate cut. This could lead to a sharp correction as high-flying valuations are re-evaluated.

The week ahead will be critical, with the release of the Fed's preferred inflation gauge, PCE data, which will provide the final pieces of information before their pivotal meeting.

A Technical Perspective

Chart of the Week

U.S. small caps were the biggest beneficiary of last week’s equity rally, with the Russell 2000 index (RUT) rocketing higher by 5.5%. Since the April lows, RUT has outperformed the S&P500 index (SPX) by a margin of 700 basis points (+34% versus +27%) but still lags considerably on a longer-term view. After RUT reached it 2021 highs, it took three years to reach that level again, suffering through 30% drawdowns both before and after the late-2024 peak. In October, the index finally ascended to a new record close, and after a four-week pullback, last week’s bounce looks constructive from a technical perspective. RUT’s relative strength vs SPX is showing signs of a turnaround, potentially setting the stage for continued outperformance into next year. Last week’s catch-up in economic data boosted the probability of another rate cut this year, which typically benefits smaller companies the most. If the cutting cycle continues into next year, that could jeopardize the recent uptrend in the U.S. dollar and provide a further tailwind for RUT.

Disclaimer: This newsletter is for informational purposes only and is not investment advice.