Supreme Court decision and the Tariff Impact on Consumer Prices and Inflation:

Economic and Markets

Week Ending Jan 9th 2026

Market Recap

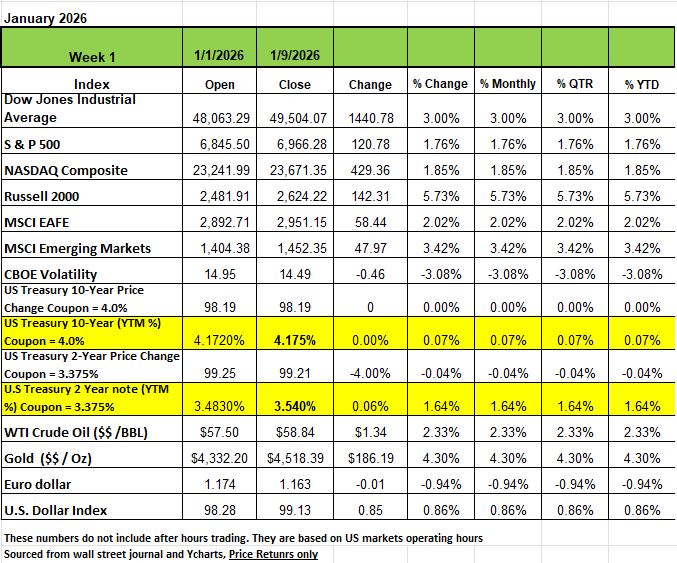

Last week’s market recap chart includes one extra day since Jan 1 landed on a Friday, we just wanted to keep the chart simple. The DOW closed the week at 49,504.07 +2.32% for the week, the S&P 500 closed at 6,966.28 and rose +1.6% last week. The NASDAQ closed at 23671.35 +1.88% on the week and the Russell 2000had the largest gain closing at 2,624.22 +4.62 on the week.

Much of the narrative was around both DOW and S&P breaking the 50,000 and 7,000 marks respectively.

Shares of homebuilders and other companies connected with the housing market were among the S&P 500's top weekly gainers after US President Donald Trump said he was instructing his "representatives" to buy $200 billion in mortgage bonds.

Trump posted on his media account "This will drive mortgage rates down, monthly payments down, and make the cost of owning a home more affordable,".

Economic data came in mixed as December nonfarm payrolls in the US rose by 50,000, missing the 70,000 expected increase according to a survey compiled by Bloomberg. The unemployment rate, however, decreased to 4.4% in December from a downwardly revised 4.5% the month before. A 4.5% rate had been expected.

US consumer sentiment improved in January to its highest point since September but remained subdued compared with year-earlier levels amid inflation and labor market concerns, according to preliminary results from a University of Michigan survey.

The Treasury yield curve flattened moderately over the course of the week as Treasury yields rose among short-duration Treasurys while dropping among long-duration Treasurys. President Trump’s action to remove Nicolas Maduro from power in Venezuela led to increased geopolitical tensions and effects on the commodities and bond markets. After Maduro’s removal, the United States began seizing oil tankers in the Caribbean, including one that began flying a Russian flag, leading to condemnation from some of America’s largest geopolitical rival. Oil rose upon Maduro’s removal, before dropping on the seizures and rising even more as investors worried about the supply of oil from Russia, and ended the week up 3%. Mixed employment reports showed that both layoffs and hiring have been slow, leading investors to speculate that inflation may still persist and that the Federal Reserve Bank would not be as quick to lower interest rates this year. Gold rose 4% as well, almost reaching an all-time high on inflation concerns and the geopolitical uncertainty. The market implied chance of a cut to the Federal Funds Rate at the January 28th meeting dropped from 17% to 5% over the course of the week, while the market implied end of 2026 rate rose from 3.06 to 3.12. The spread between the 10year Treasury yield and the 2-year Treasury yield dropped 8 basis points this week as the yield curve flattened.

By Sector

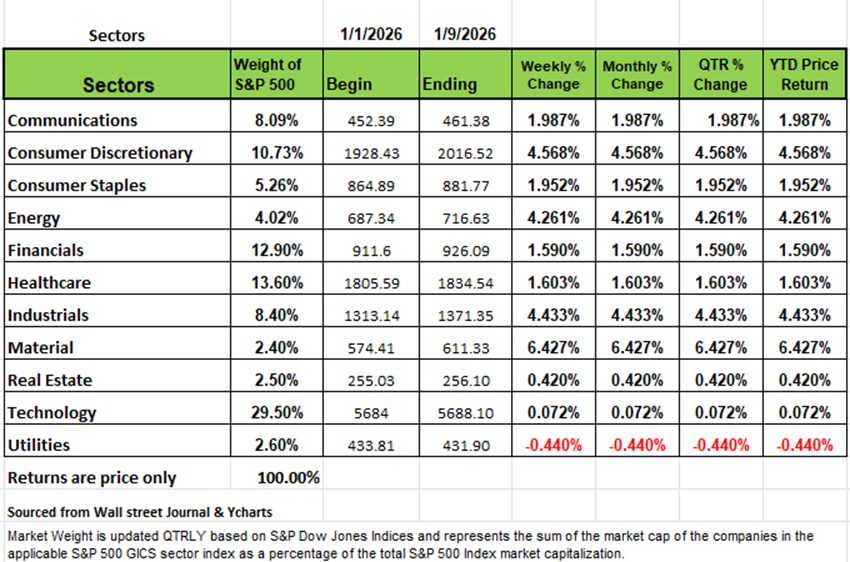

Ten of the 11 sectors of the S&P finished the week in positive territory last week with Utilities being the only decliner -1.61%. NRG Energy (NRG) was the hardest-hit stock in utilities, falling 10% on the week as the company unveiled a new CEO succession plan. Robert Gaudette was named NRG Energy's president effective immediately and chief executive effective April 30. Gaudette, who manages the company's wholesale operations and power generation, will succeed Lawrence Coben who will remain as chair and CEO until April 30 and will serve as an adviser for the remainder of the year. The consumer discretionary sector had the largest percentage increase for the week, climbing +5.8%, followed by a +4.8% rise in materials and a +2.5% advance in industrials. Communication services, energy and consumer staples also rose by more than +2% each.

Homebuilders Lennar (LEN) and PulteGroup (PHM) were among the top gainers in consumer discretionary, rising 14% and 11%, respectively, amid Trump's plan for his "representatives" to buy $200 billion in mortgage bonds. The plan also gave a boost to shares of Builders FirstSource (BLDR), which was the top performer in industrials, jumping 19% on the week.

Albemarle (ALB) had the largest percentage gain in materials, climbing 13% amid several positive analyst actions on the stock. Among them, Baird upgraded its investment rating on Albemarle's shares to outperform from neutral while raising its price target on the stock to $210 per share from $113. Analysts at Jefferies, Berenberg and BofA Securities also raised their price targets on Albemarle's shares.

This earnings season kicks off next week with reports expected from companies including JPMorgan Chase (JPM), Bank of America (BAC), Wells Fargo (WFC), Citigroup (C), Morgan Stanley (MS) and Goldman Sachs (GS).

Economic data will include the December consumer and producer price indexes, in addition to December new and existing home sales and a delayed report on November retail sales.

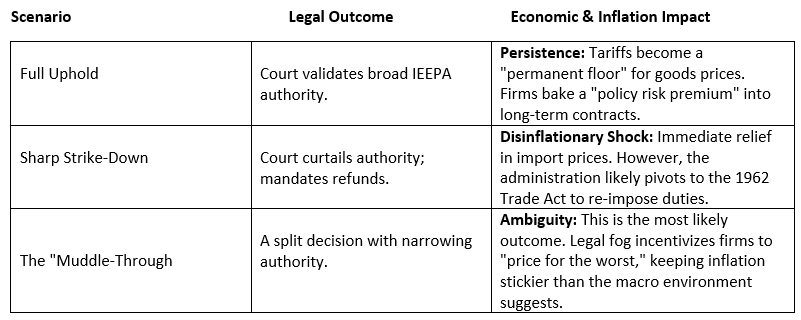

This Wednesday January 14, the Supreme Court will rule on the legality of the current administration’s Tariff policy under the International Emergency Economic Powers Act (IEEPA) While the immediate market reaction may be volatile, the true stakes lie in the long-term structural path of U.S. inflation.

Tariffs have added a modest but real layer of price pressure so far, but the Supreme Court’s decision will determine whether that pressure fades, persists, or even intensifies over time. The ruling matters less for yesterday’s inflation numbers and more for how durable and predictable tariff related costs will be over the next several years

Research on the current “Liberation Day” tariffs finds that overall manufacturing costs rose roughly 1 percentage point, with tariff exposed sectors like heavy trucks and construction machinery seeing cost increases of 2–3.9 percentage points.

Despite those higher costs, headline inflation only moved from about 2.3% to 2.7% over several months, suggesting firms absorbed a significant share of the tariff burden in margins, stockpiled inventory, or benefited from exemptions and shipping quirks that muted pass through to final prices.

Why The Supreme Court Decision Matters for Prices

The Court must decide if the executive branch has overextended its authority and whether duties already collected must be refunded. The ruling’s impact on the federal deficit is also critical; the revenue from these tariffs is a cornerstone of the "One Big Beautiful Bill," and a loss of this income would further complicate the government’s debt obligations.

For the Fed, this complicates the distinction between transitory and structural inflation: tariff-related shocks may be individually “one off,” but a rolling series of them can create a quasi-permanent risk premium in goods prices.

If the Court validates most of the program, the story will be about a modest but durable “tariff floor” under goods inflation and the implications for long-duration assets and real wage growth.

If the Court repudiates key pillars, the near-term focus will be on a potential one-time disinflation bump in import-heavy categories, with a caveat that alternative legal tools can bring tariffs back in a narrower form.

Under a split ruling, the key takeaway is not the level of any single tariff, but the institutionalization of trade policy uncertainty as a semi-permanent feature of the inflation regime, one the Fed may be reluctant to fully “look through.”

Wednesday’s ruling won’t show up immediately in CPI, but will quietly shape the range of outcomes for inflation – and monetary policy – over the next decade.

While the ruling won't instantly move the Consumer Price Index (CPI), it defines the inflation regime for the next decade. In 2025, import prices rose nearly 10% while core goods rose only 1%, meaning U.S. businesses have been footing the bill. With pre-tariff inventories exhausted, the Supreme Court’s decision will determine whether those costs stay on the balance sheet or move to the cash register.

The Week Ahead

Several interesting developments arose last week that could have a major impact on the economy’s direction in 2026. The first was in the housing market, where the U.S. government may move to buy mortgage bonds to bring down homebuyer costs while also banning investment firms from buying single-family homes. Second, the U.S. government is expected to request a 50% increase in the defense budget, to $1.5 trillion, and may look to tie defense companies’ dividends, share buybacks, and executive pay to delivery schedules. Meanwhile, the White House stepped up its pressure on the Federal Reserve over the weekend, while the U.S. Supreme Court is expected to issue its next rulings on Wednesday, which could include the legality of President Trump’s sweeping global tariffs. The flurry of news may introduce some caution among investors, despite the overall positive start to markets this year. On this week’s economic agenda, Tuesday’s U.S. CPI report will take center stage, flanked by other releases including retail sales, housing data, regional manufacturing surveys, and Treasury auctions at the longer end of the curve.

Earnings season also gets underway on Tuesday, with reports from the major U.S. banks sprinkled throughout the week along with technology giant Taiwan Semiconductor. The international calendar is light, highlighted by China’s trade balance figures and the UK’s monthly GDP up.