The Revenge of the Physical World

Newsletter

Week Ending February 13th 2026

Market Recap

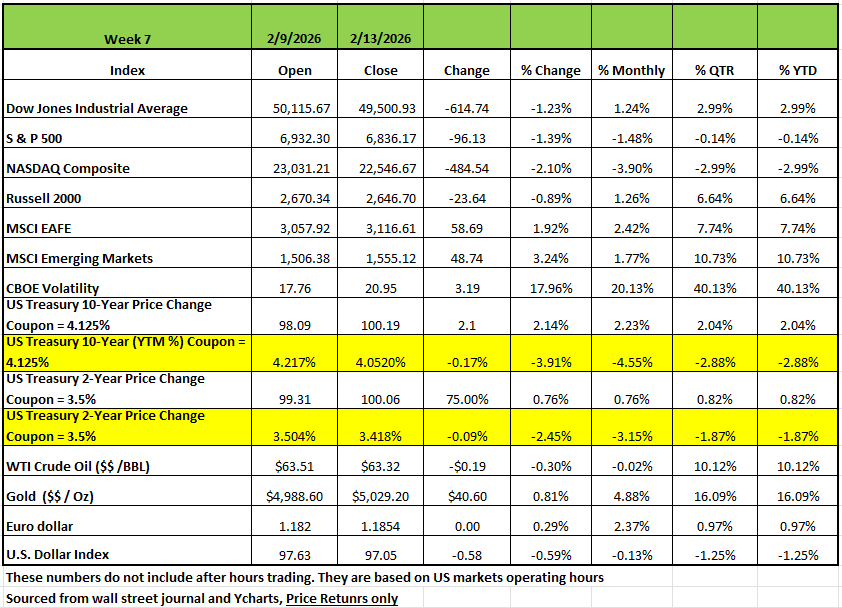

All Four of the major indices were down on the week ending Feb 13th 2026 with the NASDAQ posting the largest decline with a -2.1% this brings the index down -2.99% on the year so far. This was followed by the S&P 500 with a -1.48% decline and the DOW -1.23%. The Russell 2000 had a -0.89% decline

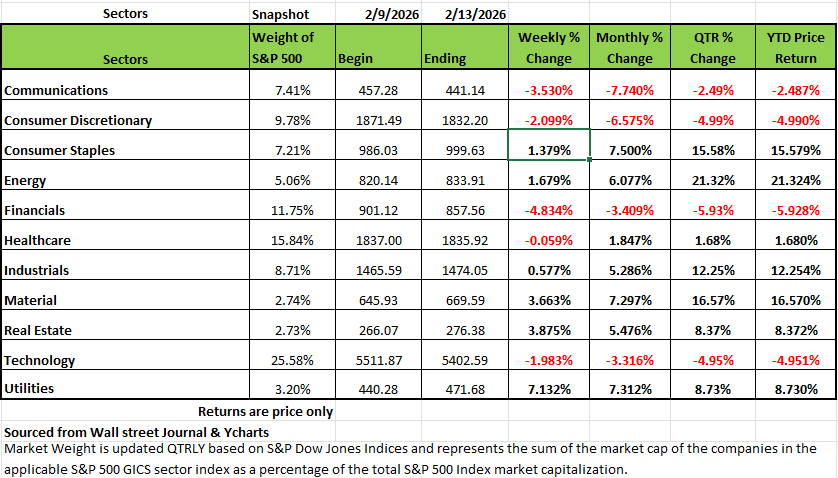

The declines in S&P were led by the financial (4.38%) and communication services (-3.53%) sectors which outweighed utilities-led gains of +7.132%. The week's decline pushed the S&P 500 into the red for the year as the market benchmark is now down -0.1% for 2026.

While many companies reported quarterly results above analysts' expectations for the just-ended quarter, investors were concerned by some companies' guidance for the coming quarters.

Cisco (CSCO) was among them. The networking equipment maker had better-than-expected results for the quarter ending Jan. 24, but it projected a sequential decline in adjusted gross margin for the current quarter amid rising memory prices. Shares fell- 9.4% in the week.

In economic data, a delayed report on January payrolls showed the US economy added more jobs than expected in January, while the unemployment rate fell versus Wall Street's views for it to hold steady.

The US seasonally adjusted consumer price index, a measure of inflation, rose by 0.2% in January, tamer than the expected 0.3% increase and a 0.3% gain in December. Still, the core CPI, which excludes food and energy prices, matched the consensus estimate for a 0.3% increase; this compared with a 0.2% rise in December

Existing home sales dropped sharply in January 2026, largely because winter storms delayed closings, but activity should bounce back as weather conditions normalize. Even with improvements in affordability such as lower mortgage rates, slower home-price growth, and rising wages, sales will remain historically low due to tight inventories and homeowners staying put with previously locked‑in low rates. Despite these constraints, underlying conditions have improved enough to support a modest upward trend in sales later in 2026.

By Sector

The financial sector had the largest percentage drop of the week, sliding -4.8%, followed by a -3.5% decline in communication services, a -2.1% fall in consumer discretionary and a -2% drop in technology. Health care also edged lower.

The hardest-hit stocks in the financial sector included Arthur J. Gallagher (AJG), which lost -14%, followed by Ameriprise Financial (AMP) and Willis Towers Watson (WTW), each down -13%.

In communication services, Netflix (NFLX) shares fell -6.5% as Ancora Holdings, which holds a roughly $200 million interest in Warner Bros. Discovery (WBD), issued a presentation laying out "strong opposition" to the proposed merger of Warner Bros. with Netflix.

On the upside, utilities jumped +7.1%, followed by a +3.9% rise in real estate and a +3.7% gain in materials. Energy, consumer staples and industrials also rose.

Vistra (VST) topped the utilities sector's gainers, climbing +15%, amid an investment rating upgrade from Jefferies. The firm now has a buy rating on Vistra's stock, up from hold, and raised its price target on the stock to $203 per share from $191.

Iron Mountain (IRM) was the best performer in real estate, rising +15%. The company reported Q4 adjusted funds from operations and revenue above analysts' mean estimates and issued upbeat forecasts for the full year.

This week's earnings reports will include Medtronic (MDT), Palo Alto Networks (PANW), Walmart (WMT), Deere (DE) and Alibaba Group (BABA).

Economic data will feature reports on Q4 gross domestic product as well as the December personal consumption expenditures price index, the Federal Reserve's preferred inflation gauge. Delayed reports on November and December housing starts and new home sales will also be released.

"The Revenge of the Physical World."

After years of digital dominance, the market is finally putting a premium on companies that touch, move, and build real things. For years, the market’s "gravity" was centered in the cloud—software, social media, and AI hype. For three consecutive years, owning the market essentially meant owning seven stocks. Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla — the Magnificent Seven — accounted for more than half of the S&P 500's total return in both 2023 and 2024 and still contributed over 40% of the index's gain in 2025. You didn't need a view on sectors, didn't need to dig through balance sheets, and didn't need to worry much about valuation discipline. You just needed to own the biggest names in AI infrastructure and hold on. That era appears to be over.

The Great Dispersion of 2026

While the S&P 500 appears to be treading water near 7,000, this "index inertia" masks a historic split. For the first time since the early 2000s, market dispersion is hitting the 99th percentile.

The Laggards: The "Magnificent Seven" (now making up a record 40% of the S&P 500) are dragging the index down. As the hype around AI moves into a "show me the money" phase, tech-heavy leaders like Microsoft and Adobe have faced selling pressure.

It seems like we are witnessing a genuine, rotation not a momentary head-fake or a temporary flight to safety. Energy, Materials, Consumer Staples, and Industrials are off to a remarkable start this year, posting price returns of 20.2%, 15.5%, 12.3%, and 12.1% respectively through February 13th. By contrast, Communication Services and Technology — the two top-performing sectors in 2024 & 2025, currently sit well below their all-time highs, with Technology still unable to reclaim the peak it set back in October 2025. Meanwhile, Materials, Industrials, Energy, and Consumer Staples all achieved fresh record highs at the start of this month. That is a striking reversal of the dispersion pattern markets have lived with for years.

The shift came quickly, in early January. A massive sell-off in enterprise software (triggered by mounting concerns that advanced AI models were disrupting rather than enhancing traditional SaaS businesses) wiped roughly $300 billion in market value in a single session. Traders have taken to calling it "Red Tuesday." It served as the psychological breaking point that encouraged investors to cash in on years of gains in mega-cap tech and redeploy into sectors with more tangible, real-world growth stories.

Beneath the surface, the fundamental case for rotation had been building for some time. The Magnificent Seven, once posting earnings growth north of 30%, are now projecting growth for 2026 that decelerates in the teens. That deceleration matters enormously when you're paying 30-plus times forward earnings for a company. The law of large numbers is not a theory — it's math . Growing from a $3 trillion base is a fundamentally different challenge than the hypergrowth years that justified those multiples. The premium investors were paying for scarcity of growth is harder to sustain when that growth edge narrows.

Fiscal policy has also played a meaningful role. The passage of the "One Big Beautiful Bill Act" in July 2025 reinstated 100% bonus depreciation and expanded interest deductibility for domestic companies. While the Magnificent Seven sit on mountains of cash and need neither provision, the rest of the market — the "Other 493" in the S&P 500 — began to see a meaningful reduction in effective tax rates and borrowing costs. For capital-intensive manufacturers, industrials, and domestic producers, that is a direct earnings tailwind that doesn't require any AI narrative to underpin it.

Companies That Build Things

Morgan Stanley's investment committee notes that the effects of the Fed's rate-cutting cycle appear to be boosting sectors like U.S. manufacturing and financial services, supporting gains for companies with more traditional business models. The committee has explicitly recommended adding exposure to cyclical equities, including financials, energy, domestic manufacturers, and consumer services.

This isn't simply a value trade or a mean-reversion story. It reflects something more structural: the current shift toward industrials and traditional sectors suggests a return to an economy where physical infrastructure and domestic supply chains are paramount. For the past decade, the market was dominated by digital platforms that scaled globally with minimal physical assets. Deglobalization and reshoring are changing that equation. Companies that make things (that require land, labor, capital equipment, and domestic supply chains) are increasingly benefiting from both fiscal policy and geopolitical tailwinds that didn't exist five years ago.

Charles Schwab's sector research rates Industrials as Outperform for the next six to twelve months, citing solid fundamentals and the sector's potential to benefit from AI adoption on the implementation side — using artificial intelligence to drive cost efficiencies in manufacturing, logistics, and operations rather than simply building AI infrastructure.

That distinction is important. The next leg of AI monetization is not about who sells the most chips or builds the most data centers. It is about who uses AI to make their existing operations leaner, faster, and more profitable. That advantage belongs disproportionately to mid-cap industrials, healthcare providers, financial services firms, and manufacturers — not the hyper-scalers who are still spending hundreds of billions building out capacity.

What to Watch

The rotation thesis has a few pressure points worth monitoring. First, the Magnificent Seven aren't going to zero; they remain extraordinarily profitable businesses with dominant market positions and are likely transitioning from hyper-growth stocks to quality-value stocks. A re-rating lower in multiples doesn't mean a collapse in price; it may simply mean years of sideways performance while earnings slowly grow into stretched valuations, similar to what large-cap tech experienced after the dot-com era. Second, tariff policy remains a wildcard for domestically oriented manufacturers who rely on imported inputs. The reshoring thesis is compelling, but cost structures matter. Third, the Fed's path from here, with the funds rate currently at 3.50-3.75% will have an outsized effect on capital-intensive industries that are sensitive to financing costs.

The bottom line is that market dispersion is normalizing in a healthy way. Stock selection and sector allocation are beginning to matter again after years in which passive concentration in mega-cap tech was effectively the winning strategy. The era of "buy the whole shelf" in Big Tech is giving way to a market that rewards earnings delivery, margin discipline, and real asset exposure. For active managers and disciplined fundamental investors, that is the environment that creates opportunity. The companies that build things are back in the conversation. It's worth making sure your portfolio reflects that.

The Week Ahead

Volatility may remain elevated as investors consider which industry might next experience an AI- driven selloff after recent losses across the software, insurance, financial, and transportation spaces. The VIX settled at 20.6 on Friday, its highest weekly close this year. U.S. markets were closed Monday for the Presidents' Day holiday, leaving a shortened week to squeeze in a multitude of economic data. The long-awaited first estimate of Q4 GDP arrives on Friday, along with the delayed PCE price index from December. Consensus estimates are calling for around 3%

GDP growth to end 2025, but the Atlanta Fed projection of 3.7% puts an upside surprise on the table, which could affect rate cut forecasts. Minutes from the last FOMC meeting will be released on Wednesday, and recent comments from committee members have confirmed that most are comfortable waiting before deciding on further reductions. Other releases on the U.S. calendar include this month’s flash PMI surveys, multiple housing data points, and trade balance figures.

Retail giant Walmart will report earnings on Thursday before the market opens. On the international side, the UK has inflation, employment, and retail sales updates on the docket, while the flash PMIs are the main event for the rest of Europe. In Japan, stock market and currency rallies could extend while giving the central bank more fuel for rate hikes if the Q4 GDP estimate shows a bounce back from the prior quarter’s contraction

This article is provided by Gene Witt of Optimized Capital LLC (A wealth management advisory Firm) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. Optimized Capital is a registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about Optimized Capital’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents.

#FinancialAdvisor, #investmentmanagement#wealthmanagement#financialplanning#retirementplanning#401kplans