Repo Market Alarms: The Vanishing Liquidity Buffer and Rising Economic Risk

Newsletter

Week ending Oct 31, 2025

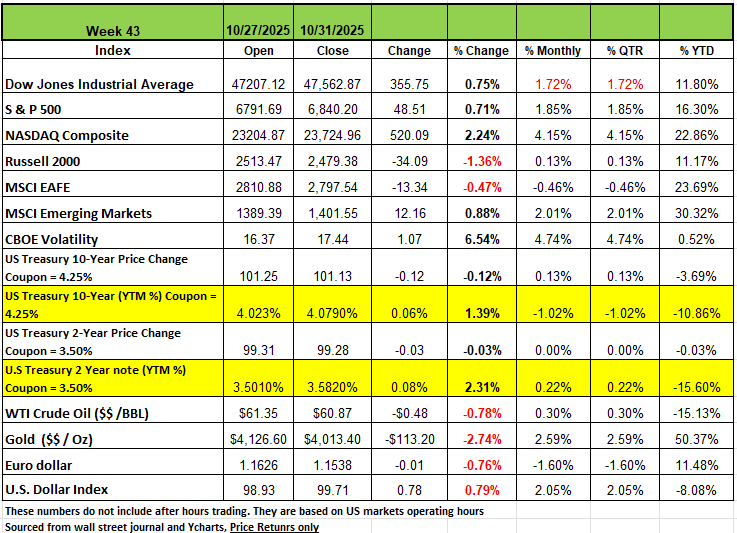

The first month in Q4 is now behind us leaving another 61 days (38 trading days) before the close of 2025. Last week only one of the four major indices posted a decline the Russell 2000 ended the last week of October -1.36% and only up 0.13% on the month. The NASDAQ posted the largest gain last week, +2.24% and + 4.15% on the month this was followed by the DOW and S&P 500 both up +0.75% and 0.71%, respectively, +1.72% and 1.85% on the month of October. The U.S. President met with Chinese President on Thursday to finalize a one-year trade agreement between the world's largest economies that is expected to be routinely extended. China agreed to resume purchases of US soybeans, keep rare-earth exports flowing and crack down on the illicit trade of fentanyl. The US, meanwhile, will halve the tariff rate on the Asian nation related to fentanyl, cutting the overall levy to about 47%.

The Federal Reserve on Wednesday cut interest rates by 25 basis points, Federal Funds Rate from 4.25 to 4.00. but Fed Chair Jerome Powell said another reduction in December is not set in stone.

"In the committee's discussions at this meeting, there were strongly differing views about how to proceed in December," he said. "A further reduction in the policy rate at the December meeting is not a forgone conclusion -- far from it." This led yields to rise moderately on Wednesday as investors speculated that rates would not be cut as quickly as previously expected.

Investors also weighed the implications of a continued government shutdown, which has now entered its 4th week, and no tangible progress was made on an end to the stalemate. The market implied probability of a rate cut at the December meeting dropped from 100% to 68% and the implied end of 2026 rate rose from 2.93 to 3.03.

Major economic reports (related consensus forecasts, prior data) for this week include Monday: October Final S&P Global US Manufacturing PMI (52.2, 52.2), October ISM Manufacturing (49.4, 49.1), September Construction Spending MoM (n/a, n/a); Tuesday: September Trade Balance (n/a, n/a), September Factory Orders (n/a, n/a), September Final Durable Goods Orders (n/a, n/a); Wednesday: October 31 MBA Mortgage Applications (n/a, 7.1%), October ADP Employment Change (-20k, -32k); October ISM Services Index (50.9, 50.0); Thursday: November 1 Initial Jobless Claims (n/a, n/a), September Final Wholesale Inventories MoM (n/a, n/a); Friday: October Change In Nonfarm Payrolls (n/a, n/a), October Unemployment Rate (n/a, n/a), November Prelim. U. of Michigan Sentiment (53.0, 53.6).

Sectors

By Sector four of the 11 sectors ended the week in positive territory, led by information technology +2.97% and consumer discretionary +2.77%. with real estate declining -3.9% and materials shedding -3.7%, respectively.

Within the information technology sector, Teradyne ( TER ) led the pack after reporting Q3 results that beat the Street's expectations, and its Q4 guidance came in above analysts' projections. Shares jumped 26% this week.

Five members of the so-called Magnificent 7 group, which comprises more than a third of the S&P 500, reported earnings on Wednesday and Thursday. The top gainer in consumer discretionary was Amazon ( AMZN ), which reported Q3 earnings and sales that outpaced analysts' estimates. Morgan Stanley said in a Friday note that Amazon ( AMZN ) is poised to see faster growth in its web services business due to expanding data center capacity, increasing chip availability and surging backlog. Shares of Amazon ( AMZN ) ended the week +8.9% higher, followed by Alphabet (GOOG, GOOGL), which jumped +8.2%, and Apple (AAPL), which climbed +2.9%. Meta Platforms ( META ) shares fell more than +12% during the week, and Microsoft ( MSFT ) declined 1.1%, reflecting the impact of their planned capital expenditures related to artificial intelligence.

On the downside, shares of Alexandria Real Estate Equities ( ARE ) in the real estate sector sank 25% this week as Q3 adjusted funds from operations and revenue fell. The company also lowered the midpoint of its adjusted FFO outlook for the full-year 2025.

This week's earnings calendar includes Amgen ( AMGN ) , Uber Technologies ( UBER ) , and Advanced Micro Devices ( AMD ) .

The economic data fog is likely to extend to next week amid the federal government shutdown. Data releases from private agencies will include October's ISM Manufacturing and Services PMI, Challenger job cuts, and the Michigan Consumer Sentiment survey.

Repo Market Alarms: The Vanishing Liquidity Buffer and Rising Economic Risk

The U.S. repo (repurchase agreement) market, the financial system’s essential circulatory system for short-term funding, is showing signs of strain. While the market is not in crisis, a combination of Federal Reserve policy actions and surging government debt is eroding the safety buffers put in place after the 2008 financial crisis, which is raising concerns about potential liquidity squeezes and financial stability.

The Primary Concern: The Reverse Repo Drain

The most conspicuous development is the rapid depletion of the Federal Reserve’s Overnight Reverse Repurchase Agreement (ON RRP) Facility. The ON RRP facility was a key tool during the quantitative tightening (QT) phase, acting as a "sponge" to absorb excess cash (liquidity) from money market funds (MMFs) and other non-bank financial institutions. At its peak, this facility held trillions of dollars, effectively stabilizing the money markets by offering a risk-free investment floor.

However, as the U.S. Treasury has accelerated its issuance of short-term bills (T-bills) to fund a widening fiscal deficit, MMFs have been shifting their cash out of the ON RRP and into the more lucrative T-bills, causing a problem.

The Looming Danger to the Economy

As the ON RRP balance approaches zero, the financial system loses its most significant shock absorber.

Bank Reserves Under Pressure:

The liquidity drain shifts from the ON RRP directly onto bank reserves. Bank reserves are the bedrock of the financial system’s ability to function smoothly. If reserves fall below what banks deem "ample" for regulatory and operational purposes, the demand for cash becomes highly inelastic.

The 2019 Precedent:

The last time bank reserves hit a perceived scarcity level was in September 2019. A sudden convergence of corporate tax payments and a large Treasury debt settlement caused the overnight repo rate to spike dramatically from around 2% to over 8% in a single day. This event, now known as the "repo crisis," required immediate and large-scale intervention by the Federal Reserve to restore order.

Increased Volatility Risk:

Without the ON RRP absorbing fluctuations, routine market events (like tax deadlines, large quarterly Treasury settlements, or even temporary issues in counterparty trust) could lead to disproportionately sharp increases in short-term funding costs. This volatility in the funding market can quickly spill over and destabilize other financial segments.

Structural Strains

The broader repo market, which includes private transactions, is facing its own set of pressures. which is why we have a Fiscal-Monetary Conflict

The large and sustained Treasury issuance to finance the U.S. deficit is a key driver of current repo market strain. This constant supply of securities requires a parallel supply of cash from the repo market. The massive demand for short-term funding runs counter to the Fed’s policy of Quantitative Tightening (QT), which is designed to reduce liquidity.

The Basis Trade Risk

A highly scrutinized activity is the Treasury-based trade, where hedge funds use repo financing to bet on the small price difference between Treasury cash bonds and their corresponding futures. This trade often involves high leverage.

Systemic Risk:

If repo rates were to spike, or if a sudden event forced a simultaneous, massive unwinding of these leveraged positions, it could trigger fire sales of assets, potentially overwhelming dealer balance sheets and transmitting distress throughout the financial system. Remember what happened to Silicon Valley Bank

Post-2008 financial regulations, such as the Supplementary Leverage Ratio (SLR), increase the cost for banks to expand their balance sheets to accommodate large volumes of repo activity. This limits the capacity of banks to act as liquidity intermediaries, especially during stress. The existence of the Fed’s Standing Repo Facility (SRF) (a permanent backstop designed to inject cash) is meant to counteract this. However, any sustained or significant usage of the SRF is an indication that private sector intermediation is failing to meet demand.

A Narrowing Margin for Error

While the U.S. financial system has powerful backstops like the SRF, market liquidity is trending toward constraint. The effective loss of the ON RRP facility's multi-trillion-dollar buffer means that the financial system's capacity to absorb shocks is thinner than it has been in years. Policymakers are now walking a tightrope, balancing the need to control inflation by tightening financial conditions while avoiding an accidental liquidity event that could seize up funding markets, halt credit flow, and trigger a broader economic slowdown. The repo market has become the most important real-time barometer of this challenge. If you’re wondering what could cause the next significant market correction this may be the very reason you have been looking for.

The Week Ahead

This week’s economic releases, unaffected by the shutdown,include ISM manufacturing and services PMIs along with November’s preliminary consumer sentiment index and inflation expectations. Midweek, the Supreme Court will hear oral arguments regarding the legality of tariffs imposed by the Trump administration. Though the court may not hand down its ruling for several months, any headlines from the proceedings may generate some market volatility. Earnings season is starting to wind down, but a few reports to note include Palantir, Advanced Micro Devices, Qualcomm, and Sandisk. FOMC members will resume public appearances this week, and their commentary could be critical in laying the foundation for the December meeting. On the international side, central banks in the UK and Australia have rate decisions on tap. Pundits put the odds of a cut from the Bank of England at around 30%, while the Reserve Bank of Australia is expected to hold rates steady. Finally, China is tentatively scheduled to release trade balance figures on Thursday evening, with an inflation update to follow on Saturday