The Casino Economy: Is the Stock Market Turning into a Gambling Platform?

This article is provided by Gene Witt of Optimized Capital LLC. for general informational purposes only. It is an opinion, not investment advice This information is not considered to be an offer to buy or sell any securities or investments and again not to be considered investment advice. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. Optimized Capital Registered Investment Adviser (RIA) that maintains a principal place of business in the State of Illinois and Indiana. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements.

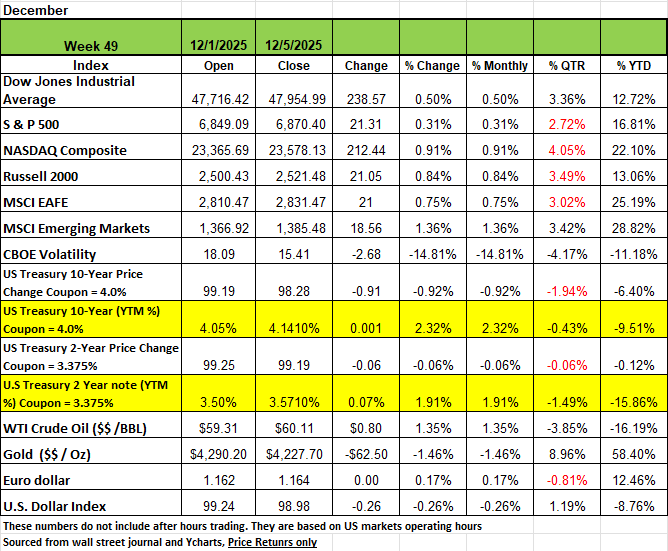

Market Recap

All four of the major indices were up for the week ending Dec 5, 2025. T gains were minimal with the NASDAQ posting the largest gain of 0.91% followed by the Russell 2000 0.84%, The DOW 0.50% and the S&P 500 0.31% The S&P 500 index gains led by the energy and technology sectors slightly outweighed declines led by utilities and health care.

The S&P 500 ended Friday's session at 6,870.40 and is up 16.8% for the year. Delayed government data released Friday showed US consumer spending slowed in September. The annual personal consumption expenditures headline price index accelerated to +2.8% in September from 2.7% in August, but the Federal Reserve's preferred inflation metric, which excludes food and energy, slowed to 2.8% annually from 2.9% in August. The data, which had been delayed by the federal government shutdown, come as the Fed's Federal Open Market Committee is set to meet and decide on interest rates on Wednesday.

The odds of the FOMC making a 25-basis-point rate cut were at 87% on Friday, down slightly from 88% on Thursday, but up from 62% a month ago, according to the CME Fed Watch tool.

Treasury yields ended the week mixed, with short-term maturities drifting lower while longer-dated yields moved higher. Soft labor-market signals put downward pressure on rates, but this was offset by rising global yields and reduced demand for safe-haven assets, which pushed long-term yields upward. Manufacturing activity softened again in November, with the ISM Manufacturing Index slipping to a four-month low of 48.2 and missing expectations. This marks the ninth straight month below 50, extending the contraction seen throughout 2023 and 2024. Only four of eighteen industries reported growth in October, while eleven contracted, reflecting weaker demand, softer hiring, and quicker supplier deliveries. In contrast, the ISM Services Index surprised to the upside, rising to a nine-month high of 52.6. Services have now expanded in ten of the past twelve months. The headline increase was driven largely by a jump in supplier deliveries, (likely tied to air-traffic disruptions from the government shutdown) which pushed that component to a thirteen-month high. Industrial production posted a modest 0.1% gain in September and manufacturing output was flat, but sizeable downward revisions left both measures sharply negative for the month.

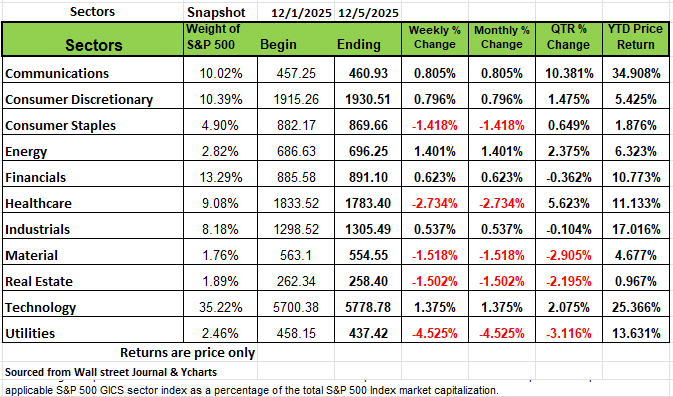

By Sector

The energy and technology sectors had the largest percentage increases this week, climbing 1.4% each. Communication services, consumer discretionary, financials and industrials also edged higher.

The energy sector's advance came as crude oil futures also rose. APA (APA) was among the top gainers in the sector, rising 8.5% as Johnson Rice upgraded its investment rating on the stock to accumulate from hold and raised its price target to $40 per share from $35.

Microchip Technology (MCHP) was the best performer in the technology sector, jumping 23% on the week as the company said late Tuesday it now expects fiscal Q3 adjusted earnings per share guidance of about $0.40, which is at the high end of its prior guidance of $0.34 to $0.40.

On the downside, utilities fell 4.5%, followed by a 2.7% loss in health care. Materials, real estate, and consumer staples also declined.

The utilities sector's decliners included shares of Exelon (EXC), which fell -7%. The company is pricing an offer of $900 million of its 3.25% convertible senior notes due 2029.

Earnings reports are expected next week from companies including Oracle (ORCL), Adobe (ADBE), Broadcom (AVGO) and Costco Wholesale (COST).

Economic data this week will include the September US trade deficit as well as delayed reports on October job openings and the Q3 employment cost index. The FOMC will hold its two-day December meeting, concluding with a rate decision on Wednesday.

The Casino Economy:

Is the Stock Market Turning into a Gambling Platform?

There seems to be a shift happening in our society, a growing interest in betting on everything that seems to be in vogue. From sports apps that allow you to bet on minute-by-minute plays to outcomes of political elections or Fed decisions on interest rate moves Americans are moving in the direction of spending their money on betting more than on investing. Maybe it’s the idea of a quick return that is driving more people to these platforms.

In recent years, veteran investors, such as figures like Warren Buffett, have expressed a growing concern that the stock market is increasingly resembling a gambling platform rather than a vehicle for building long-term wealth. This sentiment is fueled by the rise of commission-free trading apps, such as Robinhood Hood that give easy access to high-risk instruments like options, and the pervasive "get rich quick" mentality amplified by the media, especially social media.

While the stock market remains a vital mechanism for capital allocation and genuine investment, the behavioral shift towards frequent, speculative, short-term trading is undeniable.

Investing vs. Gambling: The Key Difference

The fundamental distinction between investing and gambling lies in time horizon and expected return. Investing is the allocation of capital with the expectation of generating income or appreciation based on underlying economic value. Historically, the stock market (represented by broad indexes like the S&P 500) has provided a positive expected return over the long run (e.g., a 20-year investment period has historically shown a 100% probability of a positive return). Investors gain ownership in a business, which can generate profits (dividends) and capital appreciation.

Gambling is wagering on an uncertain outcome; here, the long-run expected return is negative due to the "house edge." It is a zero-sum or negative-sum game, and the activity is typically short-term, relying on chance and some probability.

Today's stock market blurs this line when traders engage in high-frequency buying and selling based on fleeting trends or speculative hype, ignoring company fundamentals. Studies suggest that a significant majority of short-term traders (as high as 70-90%) lose money, a pattern similar to casino patrons. Professional traders spend years learning to read charts and rely on technical analysis for swift moves in and out of a position. The so-called day trader/part-timer doesn’t have the experience or expertise to fully comprehend the nuances of these charts and is often distracted by performing other activities, like working at their job/career.

Strategies for the Long Term

In a volatile, casino-like environment, a long-term investment strategy is the proven defense against speculation and risk. This approach is built on patience and discipline:

Focus on Fundamentals: Invest in quality companies with strong balance sheets, consistent earnings, and effective management. You are buying a piece of a business, not a lottery ticket.

Diversification: Spread your capital across different asset classes (stocks, bonds, real estate) and sectors. This reduces the risk that a single event or sector downturn will devastate your portfolio

Dollar-Cost Averaging (DCA): Invest a fixed amount of money at regular intervals, regardless of the stock price. This prevents you from trying to "time the market" and ensures you buy more shares when prices are low and fewer when prices are high.

Stay the Course: Market volatility is a natural, inevitable part of investing. For a long-term investor, short-term fluctuations should be viewed as noise. Avoid the emotional urge to sell during a downturn (selling low) or buy into a craze (buying high).

The Trap of Short-Term Trading

Short-term trading, often driven by the pursuit of quick, exhilarating profits, which is fundamentally an attempt to time the market, a feat most financial professionals agree is nearly impossible to do consistently.

High Risk and Volatility: Short-term positions are subject to the highest volatility and often rely on technical indicators or market sentiment, rather than intrinsic value.

Erosion of Gains: Frequent trading generates significant transaction costs (even with "commission-free" apps, there are often bid/ask spreads) and, critically, higher tax burdens on short-term capital gains.

Emotional Decision-Making:

The rush of short-term gains can lead to overconfidence, and losses often trigger the dangerous psychological trap of chasing losses with increasingly risky bets. In short, while you may see viral stories of overnight fortunes, the statistics strongly suggest that consistent short-term trading is a negative-sum game for the average retail investor.

The choice is stark: you can choose to be a disciplined owner benefiting from the long-term compounding of assets, or a gambler whose biggest returns often accrue to the "house" through transaction fees and the transfer of wealth to institutional traders. Remember, time in the market is more important than timing the market.

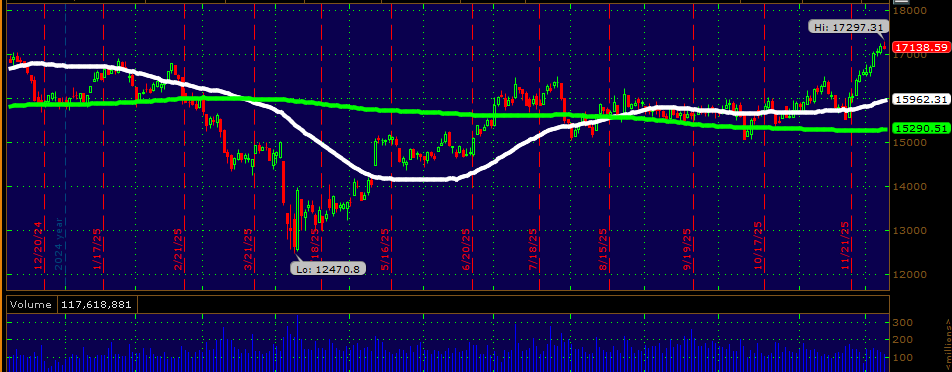

A Technical Perspective

The Dow Jones Transportation index ($DJT) rallied 3.5% last week, driven by a combination of macroeconomic data and analyst upgrades from key index components. This interest-rate sensitive sector is benefiting from the Fed’s next expected move in monetary policy. That isn’t the only catalyst, though, as several of the key stocks in the index gained momentum on stabilizing shipment volumes and easing fuel costs. That data contributed to analyst upgrades for Old Dominion Freight and JB Hunt. Although new highs are still yet to be seen, last week $DJT broke above $16,500, a significant level of technical resistance for the past four years. In technical analysis, Dow Theory states that a bull market is confirmed when both the industrials index ($DJI) and transports reach new highs. Industrials have already attained that status, while the transports are now within striking distance of the record closing high from November 2024. Technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

The Week Ahead

The Federal Reserve’s interest rate decision on Wednesday takes center stage this week, and it may be one of the most contentious meetings in years. While fed funds futures are pricing in a near-90% likelihood of a 25-basis point cut to the 3.50%-3.75% range, there is significant division among policymakers as to the Fed’s path ahead. Five of the twelve FOMC voting members have voiced skepticism over further easing due to elevated inflation, while three members of the influential Board of Governors favor a cut. This meeting will also feature an updated Summary of Economic Projections and “dot plot” of long-range rate estimates. Financial markets may be underpricing the risk of the FOMC keeping rates unchanged, which could throw cold water on the recent rally in risk assets and trigger heightened volatility if there is a pause. There is also the specter of a potential “shadow Fed Chair” situation influencing monetary policy if the White House announces Powell’s replacement soon. U.S. economic data releases are sparse this week, with the delayed September JOLTS job openings report expected on Tuesday, followed by 10- and 30-year Treasury auctions later in the week. Oracle and Broadcom, major players in the artificial intelligence spac,e report earnings this week. On the international side, there are two central bank meetings to consider. Market participants anticipate the Reserve Bank of Australia will hold rates at 3.60% after recent GDP and inflation numbers indicated that the country’s economy is running too hot to consider a cut anytime soon. The Bank of Canada is expected to keep rates flat at 2.25% as last week’s employment data suggested a resilient labor market despite the impact of U.S. tariffs. China’s inflation and trade balance figures round out the overseas agenda

Disclaimer: This newsletter is for informational purposes only. It is an opinion and is not investment advice.